CashNews.co

First Solar Inc. FSLR has established new benchmarks in the solar industry, as stated in its 2024 sustainability report, reinstating its position as the largest solar manufacturer in the Western Hemisphere and the world’s largest high-value solar panel recycler. Notably, the company has achieved a record-high global average module material recovery rate of 95%.

Moreover, FSLR’s Series 6 Plus and Series 7 TR1 are the world’s first solar panels to achieve the EPEAT Climate+ designation by meeting the ultra-low-carbon threshold of ≤400 kg CO2e/kWp.

Such notable achievements might lure investors, particularly those trading in the solar industry, to add this stock to their portfolio. However, before making any hasty decision, it would be prudent to take a look at how FSLR has performed so far in terms of share price return, the stock’s prospects as well as risks (if any) to investing in the same. The idea is to help investors make a more insightful decision.

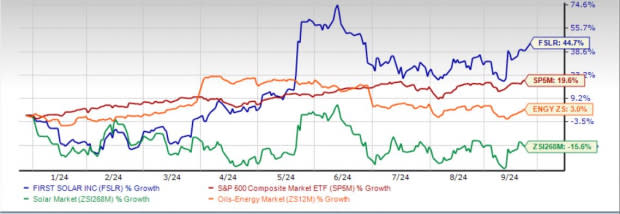

FSLR Stock Outperforms Industry, Sector & S&P 500

First Solar’s shares have surged an impressive 44.7% in the year-to-date period, outperforming the Zacks solar industry’s decline of 15.6% as well as the broader Zacks Oil-Energy sector’s return of 3%. It also outpaced the S&P 500’s rise of 19.6% in the said time frame.

First Solar also outpaced the year-to-date performance of a handful of other heavy-weight industry players like SolarEdge Technologies SEDG, Canadian Solar CSIQ and Enphase Energy ENPH, which have witnessed a loss of 77.9 %, 45% and 11.4%, respectively.

FSLR’s YTD Performance

Image Source: Zacks Investment Research

What Pushed FSLR Stock Up?

Soaring solar energy demand has been encouraging module producers like First Solar to enhance their manufacturing capabilities and generate a solid revenue stream by shipping these modules. Currently, First Solar is in the process of expanding its manufacturing capacity by approximately 7.6 GW.

The company manufactured a record 3.7 gigawatts (GW) in the second quarter of 2024 and sold 3.4 GW of solar modules. Consequently, its net sales surged a solid 24.6% year over year in the second quarter of 2024. Such solid module shipment also boosted the company’s gross profit, which improved 60.7% year over year in the second quarter. Its bottom line surged 104.4%. Such an impressive operational performance must have played a key role in boosting FSLR’s performance so far.

Is FSLR’s Growth Sustainable?

To further strengthen its footprint in the rapidly evolving renewable energy market, First Solar has always been engaged in innovating more advanced solar products. One such initiative of the company is reflected in the dedicated R&D innovation center in Ohio that FSLR completed during the second quarter of 2024. This facility features a high-tech pilot manufacturing line, which would help First Solar in innovating more technologically developed solar modules, thereby bolstering its revenue growth prospects.

During 2024, First Solar expects to invest between $1.8 billion and $2.0 billion in building new manufacturing facilities, expanding the existing ones, as well as upgrading machinery and equipment. Such a robust capital expenditure plan should enable the company to duly meet its production target of 15.6-16 GW and sell 15.6-16.3 GW of solar modules (by 2024-end), thereby bolstering its revenue growth.

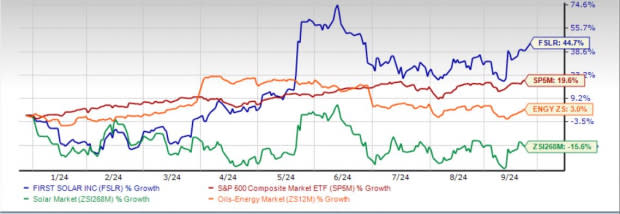

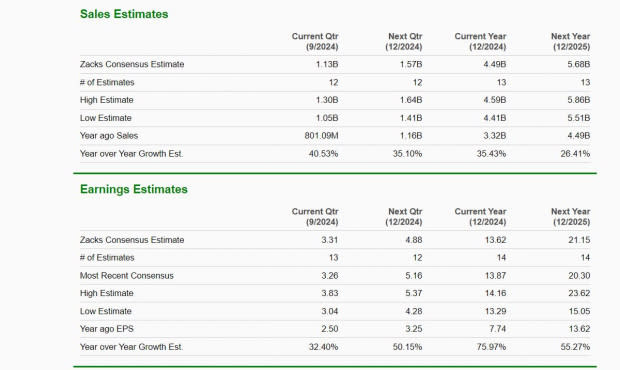

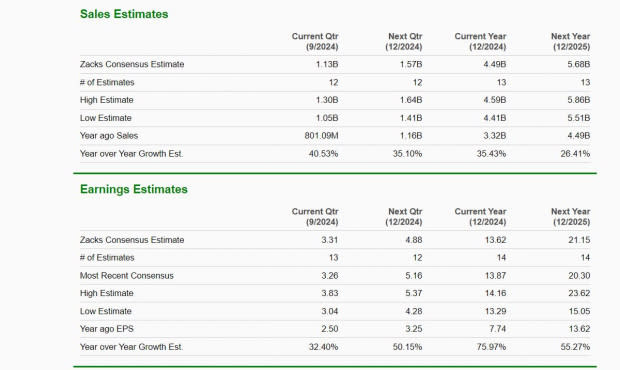

A quick sneak peek at FSLR’s near-term earnings and sales estimates reflects similar growth prospects.

Upbeat Estimates for FSLR Stock

The Zacks Consensus Estimate for third-quarter revenues and earnings reflects a solid improvement of 40.5% and 32.4.4%, respectively, from the prior-year quarter’s level.

The annual estimate figures also indicate a similar picture. The Zacks Consensus Estimate for 2024 earnings indicates an improvement of 76% from 2023, while that for revenues implies a surge of 35.4%. Its 2025 estimates also reflect similar growth trends.

Image Source: Zacks Investment Research

Risks to Consider

Despite the promising growth prospects offered by FSLR, like any other company, it poses certain risks that one should consider before investing. Notably, unfavorable international trade policies remain a cause of concern for a global trading company like First Solar. For instance, in October 2023, a U.S. coalition filed petitions with the U.S. Department of Commerce (“USDOC”) on aluminum extrusions, which resulted in further investigations. First Solar imports certain items that appear to be within the scope of the investigation. If the USDOC imposes duties, First Solar’s operating results could be adversely impacted.

Moreover, significant production capacity enhancement in China relative to global demand created an oversupply, which, in turn, has visibly dragged down the price of modules and, to some extent, created supply-demand imbalances. Consequently, if FSLR’s competitors lower module prices to or below their manufacturing costs or operate at minimal margins, it could negatively impact First Solar’s business.

Should You Make an Entry Now or Later?

In terms of valuation, FSLR’s forward 12-month price-to-earnings (P/E) is 13.03X, a premium to its Peer group’s P/E of 12.61X. This suggests that investors may be paying a higher price than the company’s expected earnings growth compared to that of its peers.

FSLR’s P/E F12M Vs Peers’

Image Source: Zacks Investment Research

Despite the surge in FSLR’s shares, this might not be the ideal time to invest in it, considering its premium valuation. However, those who already own this Zacks Rank #3 (Hold) company may stay invested as its manufacturing capacity expansion plans, upbeat estimates and innovative initiatives offer solid growth prospects.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research