CashNews.co

Insights from the Latest N-PORT Filing for Q3 2024

Hennessy Japan Small Cap Fund (Trades, Portfolio), established on August 31, 2007, is renowned for its strategic investments in smaller Japanese companies. The fund aims for long-term capital appreciation by investing in businesses that exhibit strong market growth potential, exceptional management, and financial robustness, while also being undervalued relative to their market price. This investment philosophy is meticulously applied through rigorous, on-site research, ensuring that only the best ideas make it into the fund’s concentrated portfolio.

Summary of New Buys

During the third quarter of 2024, Hennessy Japan Small Cap Fund (Trades, Portfolio) expanded its portfolio by adding two new stocks:

-

Nissan Chemical Corp (TSE:4021) was the most significant new addition with 42,800 shares, representing 1.2% of the portfolio and a total value of 1.38 billion.

-

Paramount Bed Holdings Co Ltd (TSE:7817) followed, comprising 69,800 shares, about 1.02% of the portfolio, valued at 1.18 billion.

Key Position Increases

The fund also increased its stakes in ten existing stocks, notably:

-

Penta-Ocean Construction Co Ltd (TSE:1893) saw an addition of 275,000 shares, bringing the total to 606,900 shares. This adjustment marks an 82.86% increase in share count, impacting the portfolio by 1.06%, with a total value of 2.69 billion.

-

Relo Group Inc (TSE:8876) with an additional 62,900 shares, bringing the total to 236,800. This represents a 36.17% increase in share count, totaling 2.83 billion in value.

Summary of Sold Out Positions

The fund completely exited its position in one company during this quarter:

-

Ship Healthcare Holdings Co Ltd (TSE:3360) was sold off entirely, with all 111,100 shares liquidated, resulting in a -1.52% impact on the portfolio.

Key Position Reductions

Significant reductions were made in seven stocks, including:

-

Towa Corp (TSE:6315) saw a drastic reduction by 36,500 shares, a -79.87% decrease, impacting the portfolio by -1.94%. The stock’s performance over the past three months and year-to-date has been -80.71% and -68.55%, respectively.

-

Mimaki Engineering Co Ltd (TSE:6638) was reduced by 119,500 shares, a -41.9% reduction, impacting the portfolio by -0.86%.

Portfolio Overview

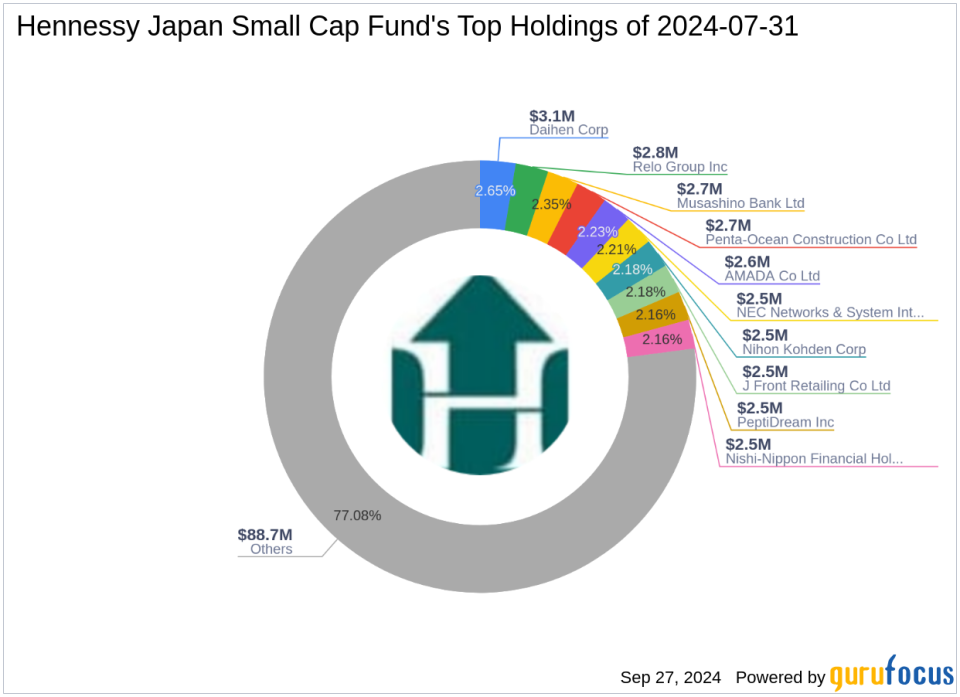

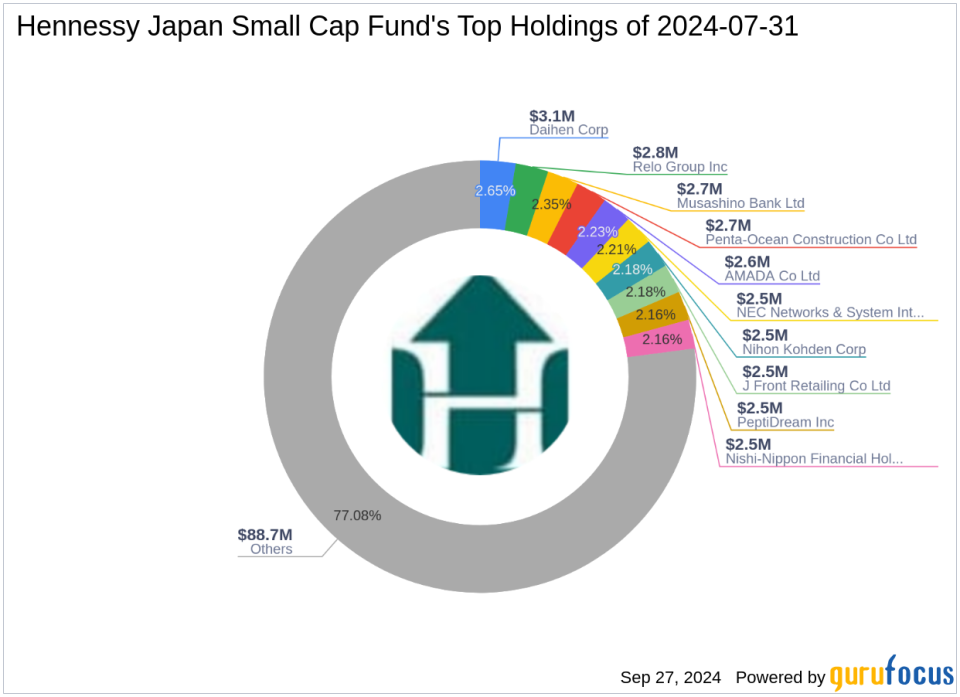

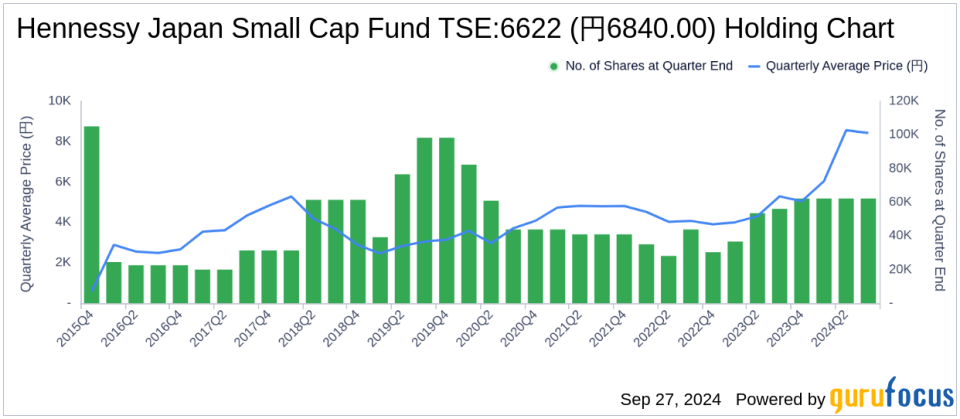

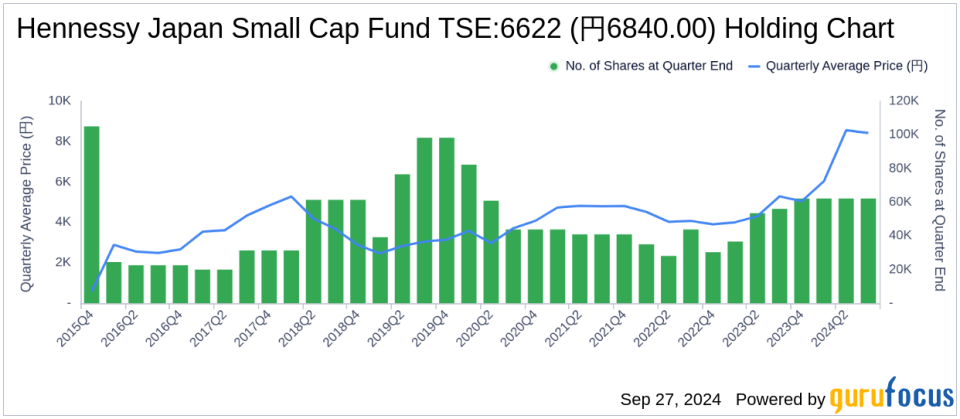

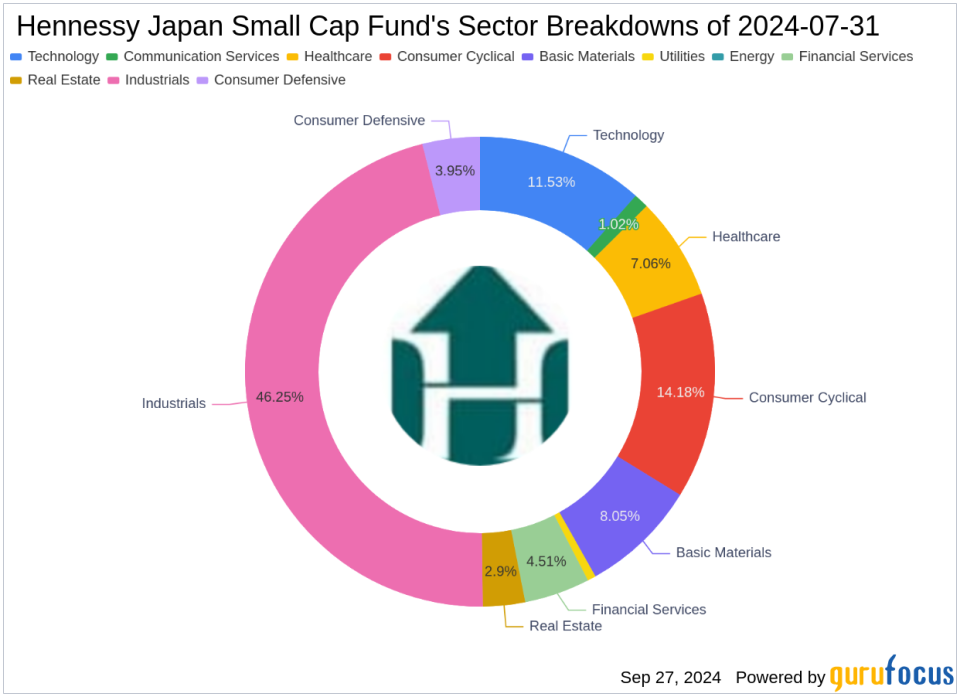

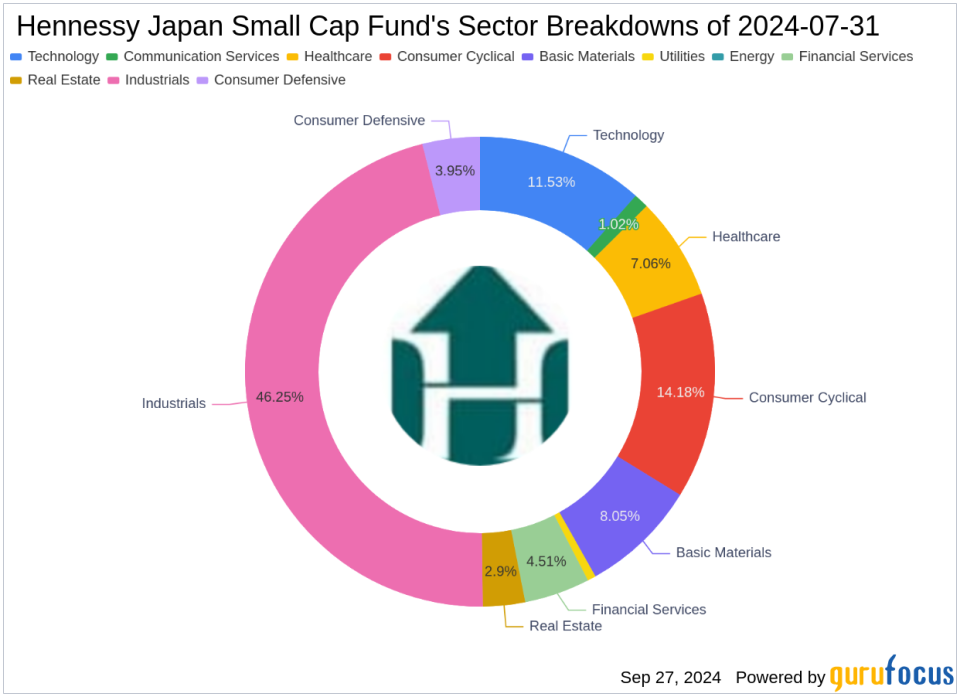

As of the third quarter of 2024, Hennessy Japan Small Cap Fund (Trades, Portfolio)’s portfolio comprised 66 stocks. The top holdings included 2.65% in Daihen Corp (TSE:6622), 2.46% in Relo Group Inc (TSE:8876), and 2.35% in Musashino Bank Ltd (TSE:8336). The fund’s investments are primarily concentrated across ten industries, reflecting a diverse yet focused market engagement.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.