CashNews.co

Insight into the Fund’s Latest Moves and Key Stock Performances in Q3 2024

Established on October 31, 2003, the Hennessy Japan Fund (Trades, Portfolio) is renowned for its strategic investments in Japanese equities, aiming for long-term capital appreciation. The fund invests primarily in companies it believes are fundamentally sound, underpinned by exceptional management, and available at attractive prices. With a focus on rigorous on-site research, the fund evaluates potential investments based on market growth, management quality, earnings, and financial robustness, often seeking arbitrage opportunities to capitalize on discrepancies between market price and fundamental value.

Summary of New Buys

During the third quarter of 2024, Hennessy Japan Fund (Trades, Portfolio) expanded its portfolio by adding two new stocks:

-

SoftBank Group Corp (TSE:9984) was the primary new addition with 109,900 shares, representing 1.63% of the portfolio, valued at 6.72 billion.

-

Mizuho Financial Group Inc (TSE:8411) followed, comprising 234,700 shares and accounting for about 1.3% of the portfolio, with a total value of 5.37 billion.

Key Position Increases

The fund also strategically increased its stakes in four existing holdings:

-

Seven & i Holdings Co Ltd (TSE:3382) saw an addition of 437,900 shares, bringing the total to 1,868,900 shares. This adjustment increased the share count by 30.6% and impacted the portfolio by 1.27%, with a total value of 22.38 billion.

-

Sony Group Corp (TSE:6758) had an additional 46,100 shares, bringing the total to 1,117,500. This represents a 25.99% increase in share count, valued at 19.85 billion.

Summary of Sold Out Positions

The fund completely exited positions in two companies:

-

Hoya Corp (TSE:7741) was sold off entirely, with all 12,000 shares liquidated, impacting the portfolio by -0.37%.

-

Terumo Corp (TSE:4543) also saw a complete exit with all 50,400 shares sold, resulting in a -0.23% portfolio impact.

Key Position Reductions

Reductions were made in 11 stocks, with significant changes in:

-

MS&AD Insurance Group Holdings Inc (TSE:8725) was reduced by 328,300 shares, a -28.23% decrease, impacting the portfolio by -1.58%. The stock traded at an average price of 3319.94 during the quarter, returning 0.24% over the past three months and 87.69% year-to-date.

-

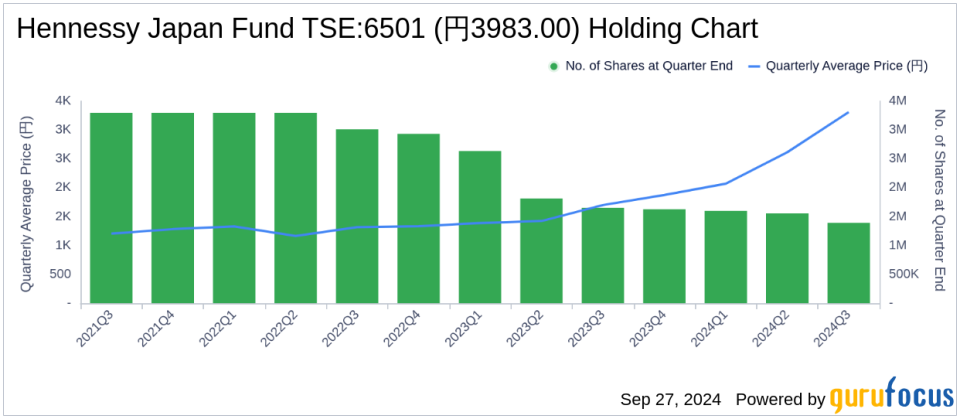

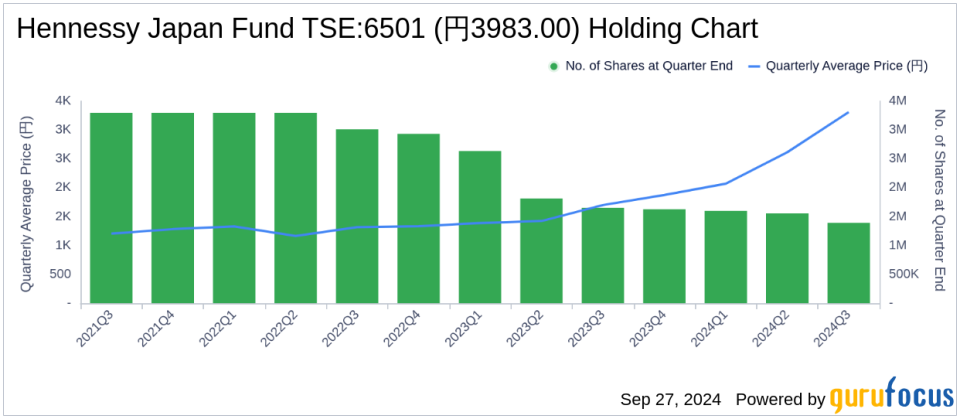

Hitachi Ltd (TSE:6501) saw a reduction of 165,000 shares, a -10.61% decrease, impacting the portfolio by -0.81%. The stock traded at an average price of 3310.81 during the quarter, with a return of 13.02% over the past three months and 97.23% year-to-date.

Portfolio Overview

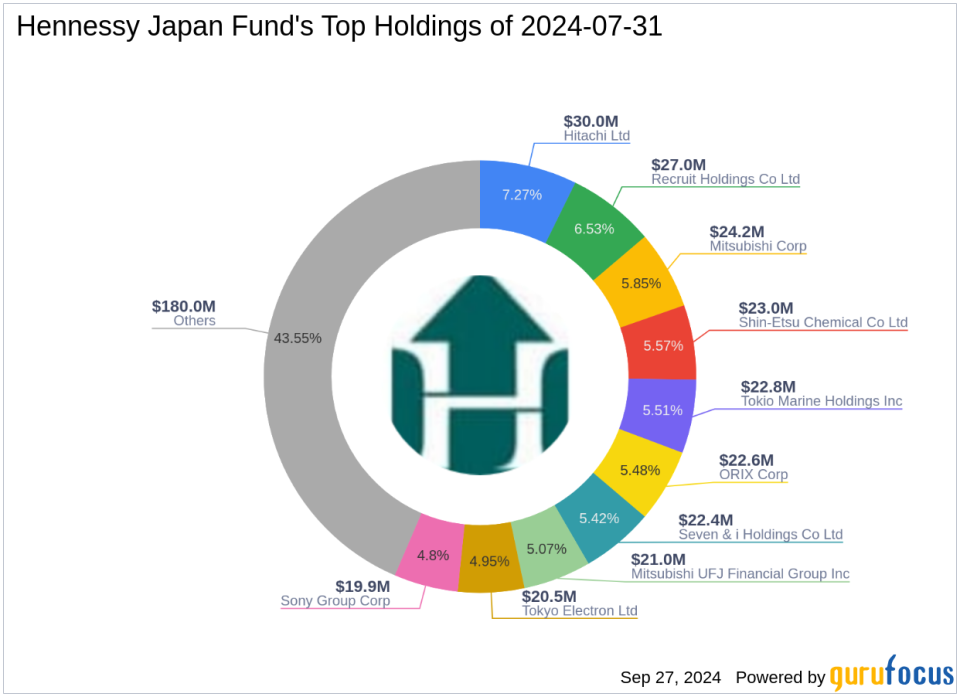

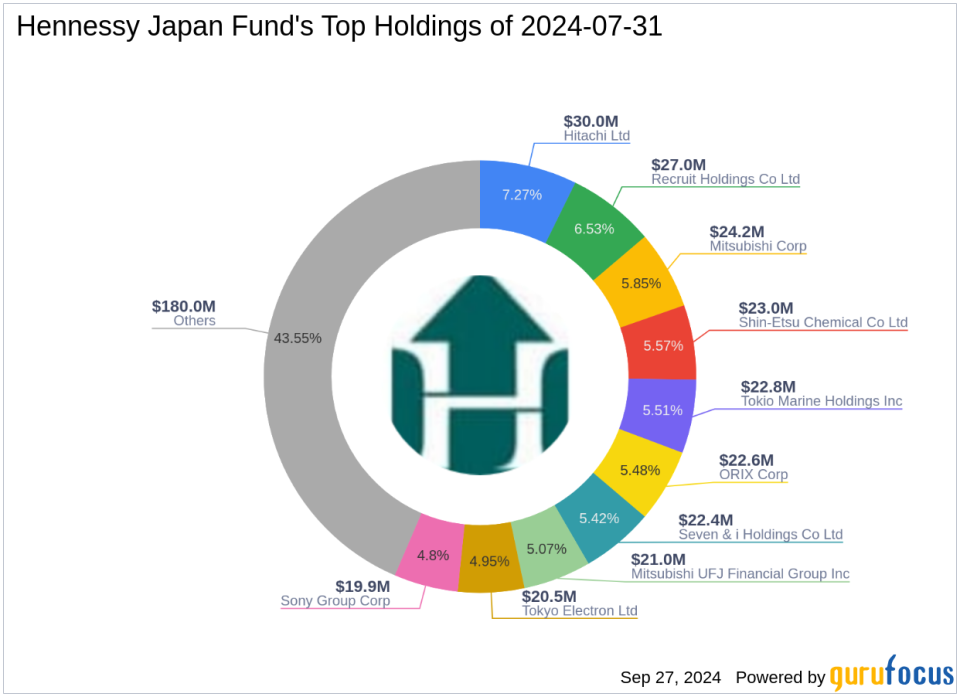

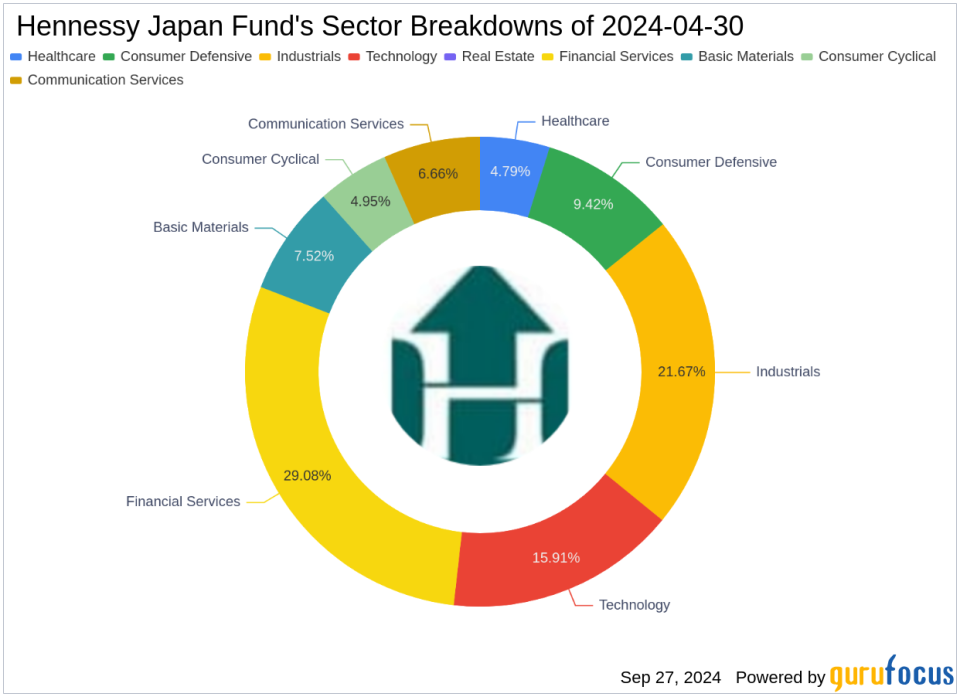

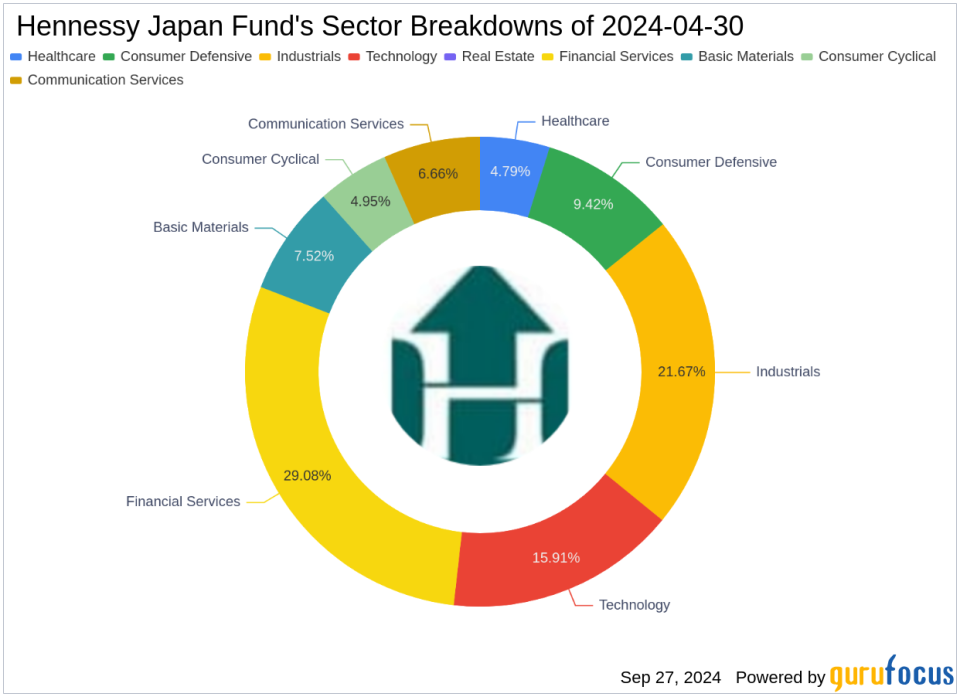

As of the third quarter of 2024, Hennessy Japan Fund (Trades, Portfolio)’s portfolio comprised 27 stocks. The top holdings included 7.27% in Hitachi Ltd (TSE:6501), 6.53% in Recruit Holdings Co Ltd (TSE:6098), 5.85% in Mitsubishi Corp (TSE:8058), 5.57% in Shin-Etsu Chemical Co Ltd (TSE:4063), and 5.51% in Tokio Marine Holdings Inc (TSE:8766). The holdings are predominantly concentrated across eight industries: Financial Services, Industrials, Technology, Consumer Defensive, Communication Services, Basic Materials, Consumer Cyclical, and Healthcare.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.