CashNews.co

The average price tag on a home jumped by nearly £3,000 in September, according to a property website.

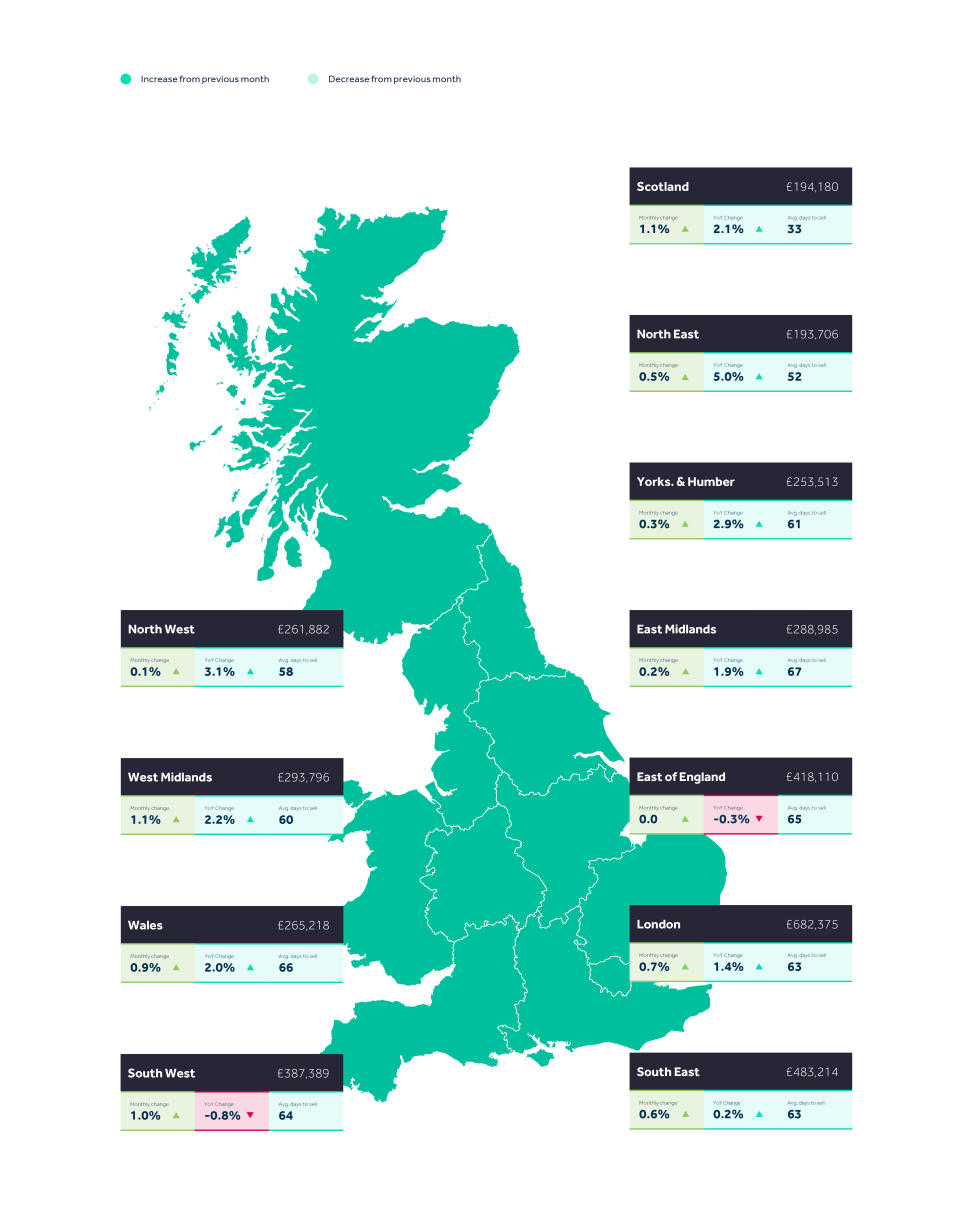

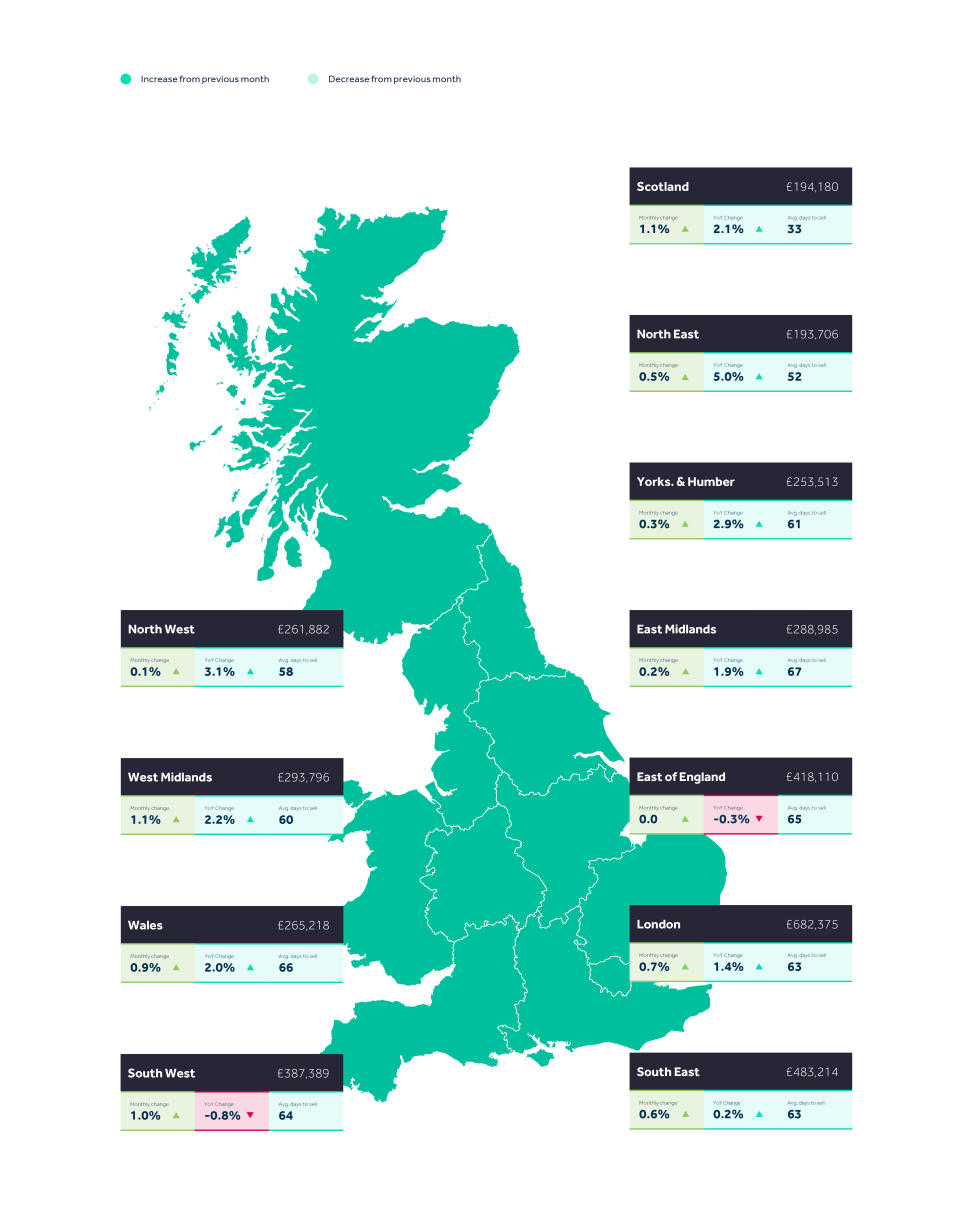

Across Britain, the typical price being asked for a home coming onto the market increased by 0.8% or £2,974 to reach £370,759.

September usually sees a month-on-month price jump, but this year’s increase of 0.8% is double the long-term average, Rightmove said.

The strong increase has been driven by a recovery in activity this summer when compared with the much more subdued market at this time in 2023, it was suggested.

Several factors are thought to be giving the autumn housing market a boost.

Mortgage rates have been edging downwards, property choice for buyers has grown, and earnings are now rising faster than both inflation and house price growth, the report said.

There are still uncertainties ahead, including the timing of another Bank of England base rate cut following the recent 0.25 percentage point decrease, and the announcements to be made in the October Budget, Rightmove added.

Tim Bannister, Rightmove’s director of property science, said: “The autumn action has started early with a strong rebound in activity from both buyers and sellers compared to the subdued market at this time last year, continuing the momentum from the better-than-expected summer market.

“The certainty of a new Government followed by the first (Bank of England base rate) cut in four years invigorated the market, opening a window of opportunity for movers to act.

“Some of this will be pent-up demand from those who had to hit the pause button until now. However, windows of opportunity tend to need a momentum of good news to stay open, and there are still uncertainties ahead which could cause some of the current market activity to ease.”

Rightmove said the average property is still taking 60 days to find a buyer, which is three days longer than at this time last year, suggesting that buyers are taking their time to find the right home at the right price.

Mr Bannister added: “Homeowners who are thinking of coming to market soon shouldn’t let the increased activity make them over-optimistic and must price competitively to sell.

“With affordability still very stretched for many, choosy buyers are taking their time to browse the increased number of homes for sale and find the perfect home at the right price.”

Jason Dainty, co-founder of estate agent Hopkins & Dainty in Derbyshire, said: “We’re seeing more sellers coming to market, and overall we’re seeing some positive sentiment amongst both sellers and buyers.

“Well-priced and attractive properties are still selling quickly, even getting interest on the first day of marketing. However, the price has to be right – otherwise, they risk being ignored by prospective buyers.”

The report was released as a lettings index from Hamptons found that the gap between rents in the North and South of England has closed to its smallest level since its records started in 2013.

In August, the average new tenancy in the South of England cost £1,318 per month, 37% more than in the North of England where rents averaged £960 per month.

This gap has narrowed from 43% in August 2023 is down from a peak of 55% in November 2021, Hamptons said.

Aneisha Beveridge, head of research at Hamptons, said: “Much like house prices, the rental North-South divide has been closing for the last five years.

“The narrowing reflects the cyclical nature of the housing market with house prices in the North of England rising 31%, nearly double the southern rate.

“These figures have been mirrored in the rental market, with rents in the North of England quickly playing catch up.

“But it’s only been in the last year that the gap has really started to narrow beyond the point we’ve previously seen.

“This has been driven by the slowing of rental growth across southern England caused by greater affordability pressures.

“While tenants in the South have seen weaker growth in percentage terms, in cash terms, they’ve faced big rises.

“A 10% increase in South of England rents would cost tenants an extra £1,581 a year, £428 more than for a tenant in the North.

“Despite the pace of rental growth slowing, it’s remained resolutely in positive territory, triggered by landlords’ higher costs.”