CashNews.co

The UK stock market has recently faced turbulence, with the FTSE 100 index closing lower due to weak trade data from China and declining commodity prices. Despite these challenges, there are still opportunities for investors to find undervalued stocks that may offer potential for growth. Identifying such stocks requires a keen understanding of their intrinsic value and the broader economic context in which they operate.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

|

Name |

Current Price |

Fair Value (East) |

Discount (Est) |

|

Integrated Diagnostics Holdings (LSE:IDHC) |

US$0.383 |

US$0.73 |

47.3% |

|

EnSilica (AIM:ENSI) |

£0.415 |

£0.81 |

48.8% |

|

Liontrust Asset Management (LSE:LIO) |

£6.24 |

£12.30 |

49.3% |

|

Gaming Realms (AIM:GMR) |

£0.40 |

£0.76 |

47.5% |

|

Topps Tiles (LSE:TPT) |

£0.4765 |

£0.91 |

47.7% |

|

C&C Group (LSE:CCR) |

£1.548 |

£2.97 |

47.9% |

|

AstraZeneca (LSE:AZN) |

£132.74 |

£248.97 |

46.7% |

|

Redcentric (AIM:RCN) |

£1.3175 |

£2.48 |

46.9% |

|

Foxtons Group (LSE:FOXT) |

£0.64 |

£1.20 |

46.9% |

|

Franchise Brands (AIM:FRAN) |

£1.845 |

£3.61 |

48.9% |

Click here to see the full list of 56 stocks from our Undervalued UK Stocks Based On Cash Flows screener.

Let’s uncover some gems from our specialized screener.

Overview: LBG Media plc is an online media publisher operating in the United Kingdom, Ireland, Australia, the United States, and internationally with a market cap of £266.58 million.

Operations: LBG Media generates £67.51 million in revenue from the online media publishing industry.

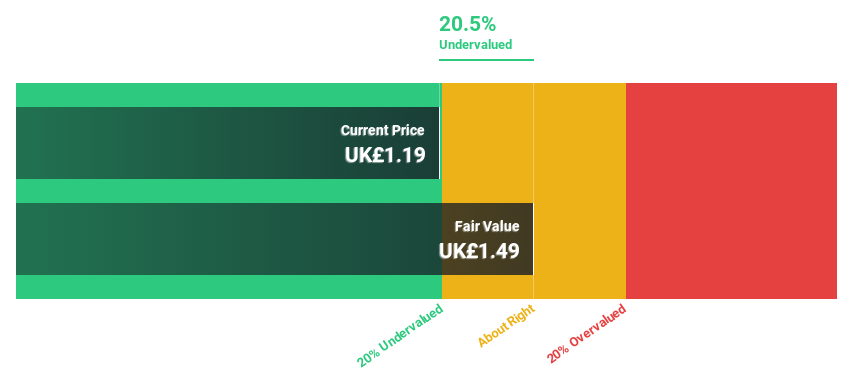

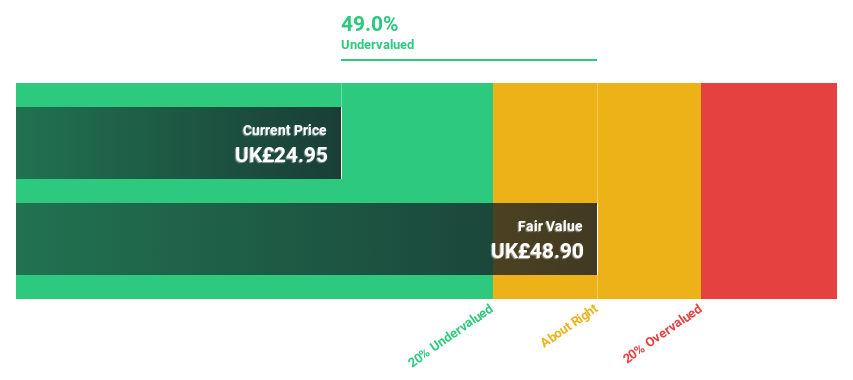

Estimated Discount To Fair Value: 22.7%

LBG Media, trading at £1.28, is undervalued by 22.7% based on its estimated fair value of £1.65. Despite a significant drop in profit margins from 8.6% to 0.9%, earnings are forecast to grow significantly at 43.84% per year over the next three years, outpacing the UK market’s growth rate of 14.3%. Revenue grew by 7.5% last year and is expected to increase by 11.7% annually, faster than the UK market average of 3.7%.

Overview: Bodycote plc offers heat treatment and thermal processing services globally, with a market cap of £1.22 billion.

Operations: Revenue segments include Aerospace, Defence & Energy (ADE) in North America (£194.50 million), Western Europe (£160 million), and Emerging Markets (£8 million), as well as Automotive & General Industrial (AGI) in North America (£97.60 million), Western Europe (£237.30 million), and Emerging Markets (£84 million).

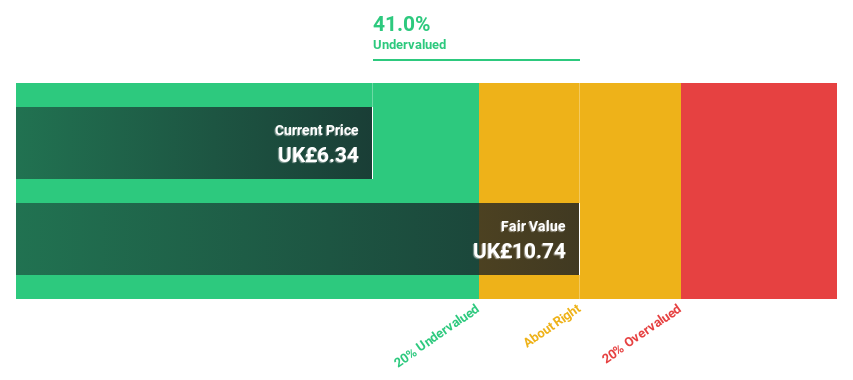

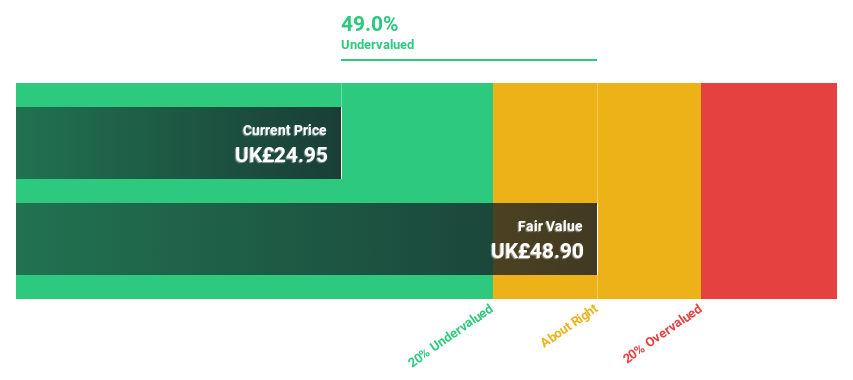

Estimated Discount To Fair Value: 38.9%

Bodycote is trading at £6.56, significantly below its estimated fair value of £10.74, indicating it is highly undervalued based on discounted cash flow analysis. Despite a recent drop in net income to £19.3 million from £42.3 million a year ago, earnings are forecast to grow at 21.2% annually over the next three years, outpacing the UK market’s growth rate of 14.3%. Revenue growth is also expected to be modestly above market averages at 4.3% per year.

Overview: TBC Bank Group PLC, with a market cap of £1.74 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan through its subsidiaries.

Operations: Revenue Segments (in millions of GEL): Segment Adjustment: 2132.38, Uzbekistan Operations: 236.42

Estimated Discount To Fair Value: 45.8%

TBC Bank Group is trading at £31.5, significantly below its estimated fair value of £58.13, indicating it is highly undervalued based on discounted cash flow analysis. Despite shareholder dilution over the past year, TBCG’s revenue and earnings are forecast to grow faster than the UK market at 18.9% and 15.3% per year respectively. Recent half-year results show net income increased to GEL 617.4 million from GEL 537.46 million a year ago, reinforcing its strong financial position amidst a high return on equity forecast of 24.9%.

Key Takeaways

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:LBG LSE:BOY and LSE:TBCG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]