CashNews.co

The Competition and Markets Authority (“CMA”) – the U.K.’s competition watchdog – has raised concerns about the proposed £15 billion Vodafone Group Public Limited Company’s VOD merger with Three UK. The agreement is likely to create the largest mobile network in the U.K., with more than 27 million customers, reducing the number of mobile operators from four to three.

In its provisional findings, the CMA has observed that the deal could disrupt the competitive market and potentially harm customers by raising mobile bills between 3% and 6%. Moreover, the competition regulator anticipates that the deal could result in consumers facing poorer services, such as smaller data packages in their contracts, while adversely impacting mobile virtual network operators that depend on larger rivals’ networks to provide their service.

What Lies Ahead for VOD’s Blockbuster Deal?

Although the industry watchdog opined that the merger could harm fair competition in both the retail and wholesale markets, it could unlock potential opportunities to improve network quality and speed up the deployment of next-generation 5G technology. Consequently, the regulator aims to seek probable solutions to its concerns before making a final decision on the legitimacy of the deal in December.

Both the company spokespersons have disagreed with the current findings and have vouched to work in unison to encourage fair competition through commitments to network investment for improved service and network capabilities.

VOD Focusing on Enhanced Network Efficiency

Vodafone is striving hard to improve network efficiency to cater to the exponential growth in data traffic. The company has joined forces with Meta Platforms Inc. META to optimize the delivery of short-form videos and ensure efficient utilization of existing network infrastructure. Meta has made improvements to its video engineering and infrastructure deployment systems for more efficient video delivery. Vodafone has successfully freed up network capacity at key 4G and 5G sites in high-traffic areas like shopping centers and transport hubs. Implementing these optimizations across Vodafone has boosted network efficiency in the European markets without compromising the viewing experience.

Impact of CMA Findings on VOD Stock

The recent CMA findings failed to dent investor confidence, with the share price rising 1.4% to close at $10.17 last Friday after the public disclosure. It remains to be seen if the stock can maintain its growth momentum as the final report is awaited later this year.

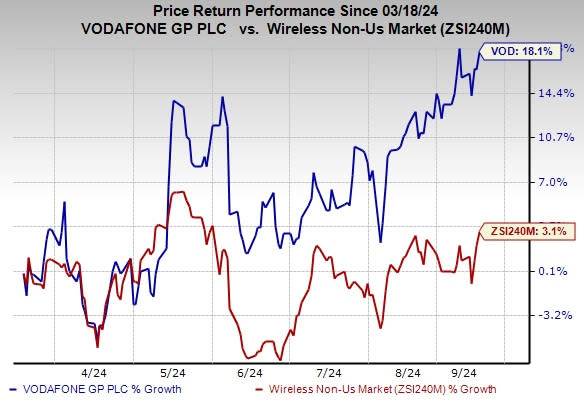

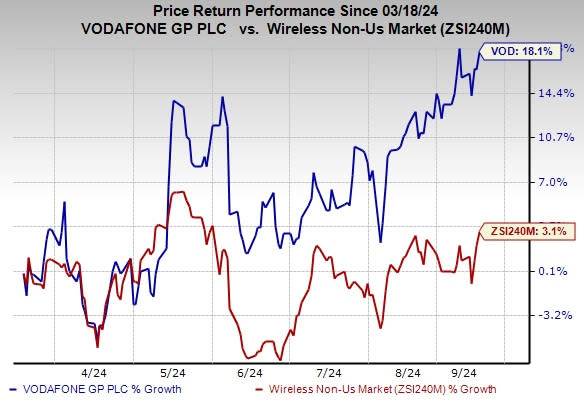

The stock has gained 18.1% over the past six months compared with the industry’s growth of 3.1%.

Image Source: Zacks Investment Research

VOD Zacks Rank & Stock to Consider

Vodafone currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy) at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experiences. Arista has a long-term earnings growth expectation of 17.2% and delivered an earnings surprise of 15%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products. It is well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

AudioCodes Ltd. AUDC currently carries a Zacks Rank #2. It delivered an earnings surprise of 10.1%, on average, in the trailing four quarters.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vodafone Group PLC (VOD) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research