CashNews.co

With the market down after a sell-off, some of the high-flying artificial intelligence (AI) stocks that used to be out of reach for most investors are starting to look more attractive. However, I’m unsure if Nvidia has become cheap enough to warrant an investment.

Instead, I’m looking at two other companies that appear to be great buys amid the sell-off: Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Meta Platforms (NASDAQ: META).

Alphabet

Alphabet is the parent of Google and other platforms like YouTube and the Android operating system. Although it is heavily invested in AI, it still generates the bulk of its revenue from ads. In the second quarter, 76% of total revenue came from ad sources, up 11% year over year. That percentage isn’t anything too impressive, but that’s where other exciting segments come in.

My favorite division within Alphabet is Google Cloud, its cloud computing wing. This is a vital part of Alphabet’s business, with cloud computing seeing a boom thanks to AI demand.

Many companies trying to make AI models don’t have the storage space available for the data needed or the computing power necessary to train the model. Instead of going out and spending millions of dollars on a server that won’t be used often, they can rent both storage and computing power from Google Cloud to train the model. This has proved successful, and with the cloud delivering 29% growth in second quarter, it gives Alphabet some much-needed growth.

Altogether, Alphabet delivered 14% revenue growth and 31% higher earnings per share (EPS) companywide in the second quarter. Those are strong figures for a mature company, yet the market is giving investors a significant discount on the stock compared to recent months.

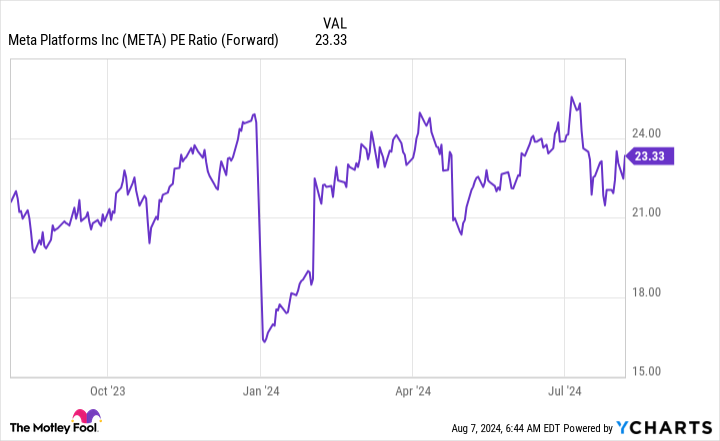

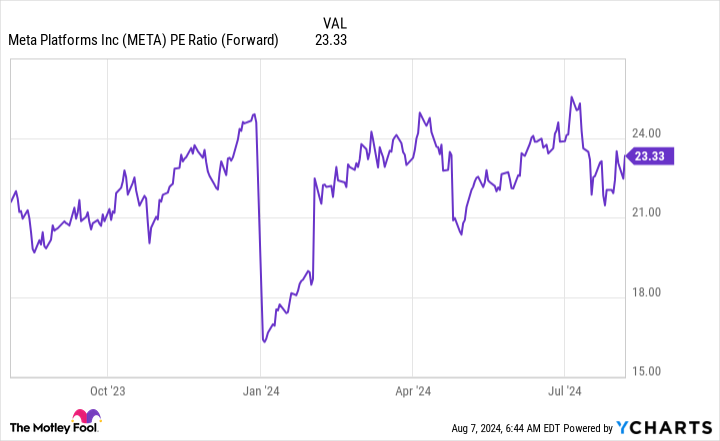

Considering that the broader S&P 500 has a forward price-to-earnings (P/E) ratio of 22.2, I think Alphabet is a fantastic stock here to buy and stash away.

Meta Platforms

Similar to Alphabet, Meta derives nearly all of its revenue from advertising. These ads are on Meta’s family of Apps, which includes Facebook, Instagram, WhatsApp, Messenger, and Threads.

The company’s market is slightly less mature than Alphabet’s, and its growth reflects that. In the second quarter, Meta’s ad revenue made up 98% of the company’s total and grew at a 22% year-over-year pace. Those are solid numbers, but Meta’s stock has dropped alongside the market after an initial rise following that report.

Although Meta hasn’t been sold off as much as Alphabet, 23 times forward earnings isn’t a bad price to pay for a company that is growing as quickly as Meta is. What’s more, Meta is expected to keep up this strong growth, with third-quarter revenue projected to rise between 15% and 22%.

However, investors must be aware that management expects 2025 expenses to increase significantly due to the cost of AI infrastructure. While few investors enjoy seeing less profits and more spending, Meta must continue to build out its AI ability so that it can continue to compete with the rest of big tech. Without that, it would be left behind and jeopardize its business.

We’ll have to see how much more spending management anticipates, but that figure won’t be available until early 2025 when Meta reports its fourth-quarter numbers and gives 2025 guidance. In the meantime, we’re left with just the facts:

Both of these factors make Meta an excellent buy, and I think the slight market sell-off is an excellent time to take advantage of it.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

Forget Nvidia: 2 Artificial Intelligence (AI) Stocks to Buy After the Market Sell-Off was originally published by The Motley Fool

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews