CashNews.co

With its economy floundering, the Chinese government recently announced a number of measures to help give it a lift. They include decreasing banks’ required reserve ratios, lowering key interest rates, and reducing the required downpayment percentage on second homes.

In addition, China will allow institutions, including brokers, funds, and insurance companies, to use financing from the central bank to purchase stocks. There is also a plan to let companies and large shareholders use government financing to buy back their shares.

Against this backdrop, let’s look at three Chinese companies that trade in the U.S. that could benefit from this stimulus plan.

Baidu

Baidu (NASDAQ: BIDU) is a Chinese technology conglomerate that is most akin to Alphabet in the U.S. It is best known for its search engine, but like Alphabet, it also owns cloud computing and robotaxi businesses. The company also owns stakes in publicly traded Chinese travel company Trip.com and video subscription service iQIYI.

With the sluggish Chinese economy and increasing competition for ads, Baidu has seen its stock struggle this year, down about 20%. In the second quarter, its overall revenue was flattish, while its online ad revenue fell 2%. One area of strength was its cloud business, which saw revenue rise 14%.

In addition to the impact of the weak macro environment and competitive landscape, the company is also in the process of trying to transform its search experience through the integration of generative AI, which it says will provide more accurate and direct answers. In August, about 18% of search results content was created by generative AI, up from 11% in mid-May.

However, the company has said this transformation is currently leading to fewer ad impressions, which is hurting revenue in the near term. Longer term, though, the company thinks this is the right strategy and it will also explore other monetization models, such as moving from a cost-per-click model to a cost-per-sale model.

While Baidu is dealing with near-term internal and external headwinds, an improved Chinese economy and consumer could go a long way toward helping to improve its search ad business.

Alibaba

Wile Baidu resembles Alphabet, Alibaba (NYSE: BABA) is similar to Amazon in the U.S., with large e-commerce, logistics, and cloud computing businesses.

While Alibaba’s stock has performed well this year, up more than 20%, it’s still down more than 40% over the past five years. It too has struggled with increased competition and a weak Chinese economy. In Q2, its e-commerce revenue fell -1%, although the company is making strides attracting more customers, as its orders grew by double-digits and its gross merchandise value (GMV) rose by high single digits. Now that its Taobao and Tmall businesses have stabilized, it will look to increase monetization on the platforms.

And similar to Baidu, its cloud computing unit has recently been a standout. While its Q2 revenue only rose 6% last quarter, the segment’s adjusted EBITA (earnings before interest, taxes, and amortization) soared 155% as it lets lower-margin customers roll off. The company also just introduced over 100 AI models to help further push growth.

While Alibaba has been making strides in its turnaround efforts, an improvement in the weak Chinese economy could go a long way in helping with those efforts.

JD.com

Similar to Alibaba, JD.com (NASDAQ: JD) operates an e-commerce and logistics business in China. JD, however, sells more direct items, so its margin profile is much lower than Alibaba’s. Nearly half its total revenue comes from the sale of electronics and home appliances.

JD.com’s stock is up nearly 15% on the year, but up less than 10% over the past five years.

It too has been feeling pressure from a weak Chinese consumer and increased competition. Last quarter, its revenue rose just 1.2%, with retail revenue increasing 1.5%. It has also been seeing strength in its smaller grocery store business, but sales of electronics and home appliances fell 4.6%.

To help try to improve its business, the company has focused on trying to improve its supply chain capabilities to offer the most competitive prices while also working to create a better user experience. It said this strategy is showing some signs of working, with solid user growth momentum in both higher-tier and lower-tier markets.

While JD.com has been making strides to improve its business, given its ties to electronics and home appliances sales, it may be the biggest beneficiary of the three to an improved Chinese consumer.

Three cheap stocks

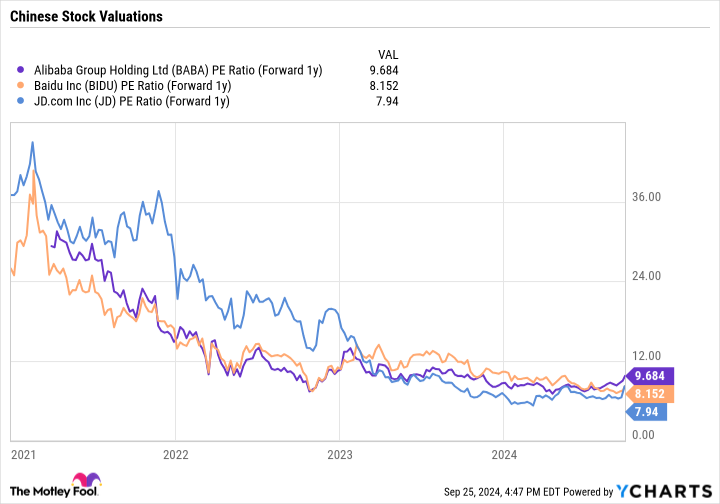

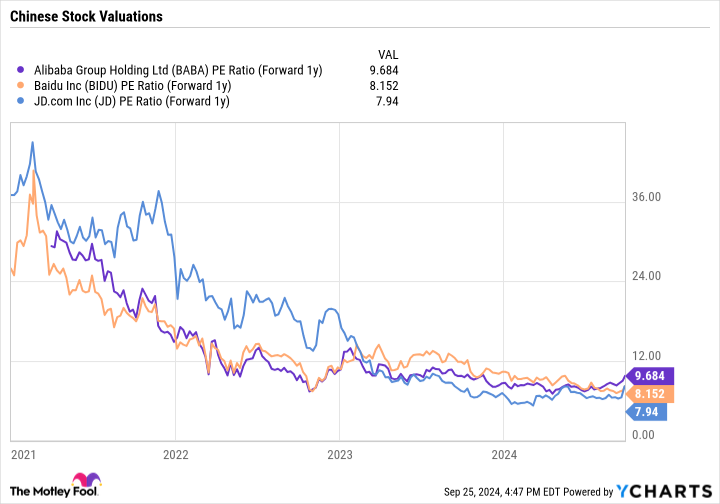

Baidu, Alibaba, and JD.com are all very cheap compared to their U.S. counterparts, with all three trading at under 10 times on a forward price-to-earnings (P/E) basis based on next year’s analyst estimates.

All three also carry a good amount of net cash on their balance sheets and generate solid free cash flow. Given this and their valuations, now could be a good time to add some exposure to these Chinese stocks, with the government looking to give the country’s economy a boost.

Should you invest $1,000 in Baidu right now?

Before you buy stock in Baidu, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Baidu wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alibaba Group and Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Baidu, and JD.com. The Motley Fool recommends Alibaba Group and iQIYI. The Motley Fool has a disclosure policy.

3 Stocks to Buy After the Chinese Stimulus Package was originally published by The Motley Fool

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews