CashNews.co

Nvidia stock (NVDA) investors saw a roller-coaster ride ahead of its Q2 earnings release in August. Its share price dropped below $100 on August 5, rebounded, and went up for six consecutive days from the 12th to the 19th. Nvidia traded at around $128 on August 21.

Nvidia’s early-month plunge was partly due to the global market turmoil after the yen-carry trade and a potential chip delivery delay caused by a design flaw in the Blackwell architecture.

The chip giant remains the AI industry leader, with an 80% market share in AI processors. But rivals like AMD are picking up the pace.

On August 19, AMD announced a 5 billion acquisition of ZT Systems to boost its GPU sales. Nvidia stock lost 2% on the next trading day. GPUs are hardware specialized in performing the matrix calculations required by AI processing.

Related: Analysts reset AMD stock outlooks after AI acquisition

Nvidia will post its fiscal Q2 earnings on August 28. Whatever the results, they will mark a key weather vane for the AI and the semiconductor industry. The earnings reports from its peer chip makers can be a good reference for earnings prediction and future stock price movements.

The No. 2 market player, AMD, delivered strong Q2 earnings on July 30, exceeding analysts’ expectations for both revenue and profits. Revenue rose 9% to $5.84 billion, while earnings increased by 19% to 69 cents a share. It also sees robust AI demand ahead.

But Intel tumbled on an earnings miss. On August 1, the company reported a net loss of $1.61 billion, compared with a net income of $1.48 billion a year earlier. Revenue and earnings were also lower than analysts’ forecasts.

Intel attributed the loss to a decision to more rapidly produce Core Ultra PC chips that can handle AI workloads, according to CEO Pat Gelsinger.

Bloomberg/Getty Images

What to expect after a record Q1 revenue

Nvidia reported record quarterly revenue of $26.0 billion for fiscal Q1 2025, up 18% from Q4 and 262% from a year ago.

The AI giant anticipates Q2 FY25 revenue of $28 billion, with GAAP and non-GAAP gross margins projected at 74.8% and 75.5%, respectively. In comparison, Q2 FY24 reported revenue of $13.51 billion, with GAAP and non-GAAP gross margins of 70.1% and 71.2%.

Related: Analysts reset targets for key Nvidia supplier after earnings

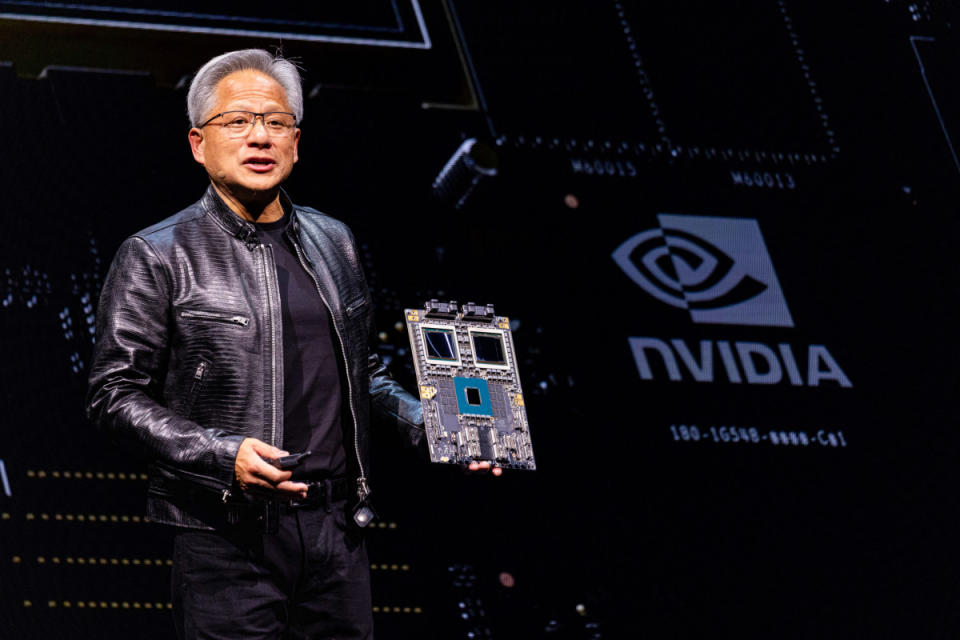

“The next industrial revolution has begun — companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center — AI factories — to produce a new commodity: artificial intelligence,” said CEO Jensen Huang in Q1’s earnings release, “We are poised for our next wave of growth.”

HSBC analyst raises Nvidia stock price target before earnings

On August 21, HSBC analyst Frank Lee raised Nvidia’s price target to $145 from $135 and kept a buy rating.

The analyst sees continued strength for Nvidia driven by underlying AI GPU demand, with “limited impact on earnings from any product roadmap delay.”

“The 2025 AI hyperscaler capex trend remains intact, along with underlying AI demand,” the analyst said.

HSBC expects Nvidia’s Q2 sales to be $30 billion, beating the company’s guidance and consensus estimates of $28 billion and $28.6 billion, respectively.

More AI Stocks:

TheStreet also reported on August 19 that Goldman Sachs analyst Toshiya Hari reiterated a buy rating on Nvidia with a $135 target before earnings, citing strong demand and Nvidia’s “robust” competitive position.

“While the reported delay in Blackwell could lead to some near-term volatility in fundamentals, management commentary, coupled with supply chain data points over the coming weeks, should lead to higher conviction in Nvidia’s earnings power in 2025,” the analyst said in a research note.

Related: Veteran fund manager sees world of pain coming for stocks

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews