CashNews.co

There’s no doubt about it: AMD (NASDAQ: AMD) has been getting beaten by Nvidia (NASDAQ: NVDA) in the artificial intelligence (AI) arms race. AMD has been busy trying to close the gap, but Nvidia is still much further ahead.

AMD recently announced its acquisition of ZT Systems, another attempt to close the gap on Nvidia. Still, I don’t think AMD is the optimal choice for investors, as Nvidia still has several key advantages.

AMD’s acquisition is a smart one, but is it too late?

AMD’s $4.9 billion acquisition of ZT Systems will allow it to better design systems with thousands of graphics processing units (GPUs). This is key because Nvidia has had a long-standing advantage in this area. By improving its offering to large cloud computing companies and others that want an industry-leading supercomputer dedicated to training AI models, AMD may be able to compete with Nvidia.

However, the hole AMD has to dig itself out of may be too deep.

In the second quarter, AMD’s data center division (the segment encompassing the hardware most closely associated with AI model development) saw record revenue of $2.8 billion, which grew at a 115% year over year. Those are fantastic results in a vacuum that would thrill most investors.

But the problem is that those figures pale in comparison to Nvidia’s.

In the first quarter of its fiscal year 2025 (ended April 28), Nvidia’s data center revenue rose 427% year over year to $22.6 billion. There’s no sugar coating it: AMD is getting smoked by Nvidia, with its data center business only a tenth the size of Nvidia’s.

The other problem is that because Nvidia has already proven its product and established relationships with many customers and end users, it has built itself a bit of a switching-cost moat. AMD will have to prove its product has better performance than Nvidia’s or provides a much better value proposition. If it struggles to do that, then Nvidia will continue eating AMD’s lunch.

While the ZT Systems acquisition is a step in the right direction, it isn’t expected to close until the first half of 2025, which means Nvidia will continue building on its existing lead.

This doesn’t bode well for AMD investors, and as of right now, I see no reason to buy it over Nvidia’s stock, especially when valuation is factored in.

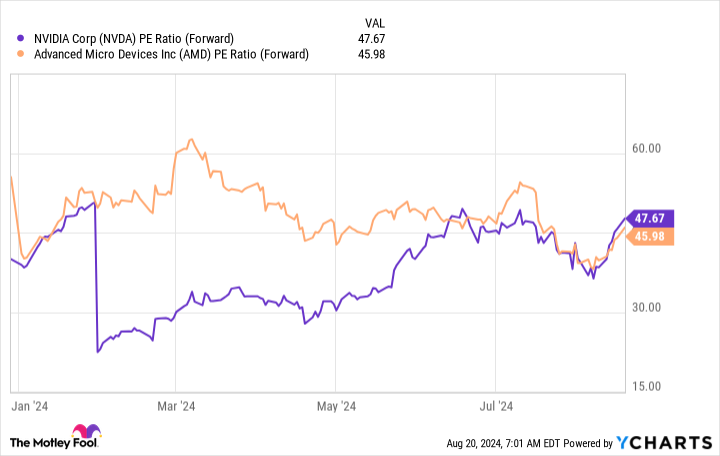

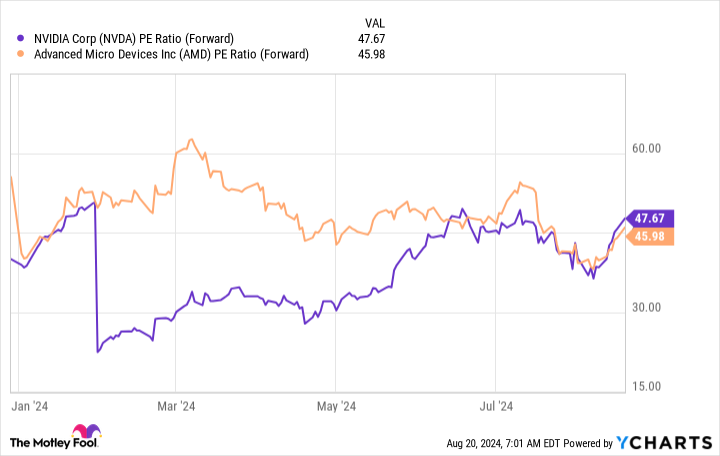

There isn’t a huge valuation difference in the stocks right now

Usually, when you see two companies competing against each other in the same industry and one is dominating the other, it earns the premium price tag. But that’s not the case here.

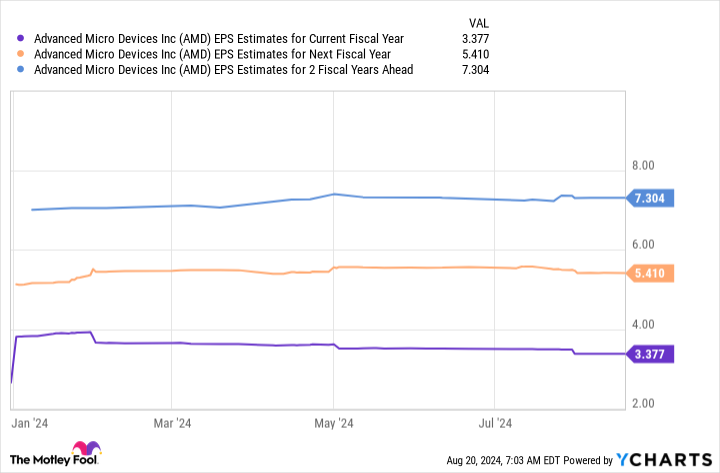

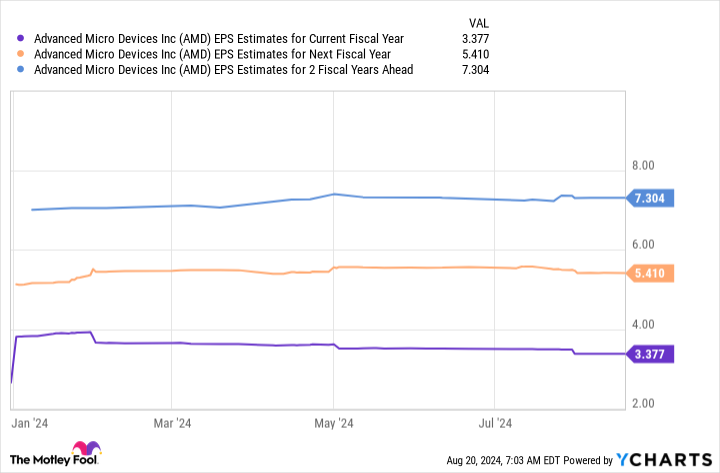

Nvidia and AMD trade for nearly the same price tag on a forward price-to-earnings (P/E) basis. Part of this is because AMD’s ancillary businesses are in a slump, and its data center business hasn’t significantly outgrown its other segments. This is why AMD’s earnings are expected to grow significantly over the next few years.

So, if you consider analyst-estimated 2026 earnings, AMD’s stock is priced at 21 times forward earnings. That’s an expensive price tag, considering you have to wait nearly two and a half years to achieve it.

The same analysis for Nvidia’s stock yields a two-year forward P/E of 30.2, which is also really expensive. However, the difference between AMD and Nvidia is that Nvidia has proven that it can generate huge growth by capturing the largest customers.

AMD is still working on that, and it may be some time before it can go toe-to-toe with Nvidia.

Considering that both companies are trading around the same price tag, I have to give the nod to Nvidia, as AMD is just too far behind to warrant an investment, even if it may look cheaper looking ahead two years.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 22, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

Here’s Why Nvidia Surpasses AMD as the Optimal Choice for Artificial Intelligence (AI) Investors was originally published by The Motley Fool

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews