CashNews.co

The rise of artificial intelligence (AI) propelled shares of Nvidia (NASDAQ: NVDA) to incredible gains over the past year, from a 52-week low of $39.23 in 2023 to a high of $140.76 on June 20. This prompted a 10-for-1 stock split, and a 150% increase in its dividend in 2024.

Now, after several consecutive quarters of impressive sales, Wall Street’s expectations of the semiconductor giant are quite high. That seems to have contributed to a drop in Nvidia’s stock after it reported earnings on Aug. 28.

Does the recent decline in Nvidia’s share price create a buy opportunity? Or did the company’s latest earnings report signal warning signs? To answer these questions, here’s a look into where the company is at now.

Customer demand for Nvidia’s products

For starters, let’s unpack the results from its fiscal second quarter, ended July 28. The company experienced a 122% year-over-year rise in Q2 sales to hit a record $30 billion.

This triple-digit revenue growth was no small feat given what it accomplished in 2023’s fiscal Q2. At that time, Nvidia achieved a 101% year-over-year sales increase as generative AI began to take off.

Following 2023’s Q2 performance with another triple-digit year-over-year increase illustrates the insatiable customer demand that exists for Nvidia’s products. It’s a key reason behind the company’s investment appeal.

CEO Jensen Huang, describing what’s currently driving this, stated, “Hopper demand remains strong, and the anticipation for Blackwell is incredible.” Hopper is the name of Nvidia’s platform for the current generation of graphics processing units (GPUs) specifically designed for AI.

The company expects Hopper GPU shipments to increase in the second half of its 2025 fiscal year. Blackwell is the next generation GPU platform, scheduled for a production ramp up in Nvidia’s fiscal Q4, and continuing into fiscal 2026.

Both the Hopper and Blackwell GPUs won accolades recently for industry-leading performance related to AI inference. Inference measures an AI’s ability to correctly make decisions and execute tasks. These results demonstrate why Nvidia products are in such high demand.

The cause of Nvidia’s Q2 post-earnings stock drop

As a result of the customer demand the company is experiencing, Nvidia estimated its fiscal Q3 revenue to reach around $32.5 billion. That represents nearly an 80% jump up from the prior year’s $18.1 billion.

Yet since Q3’s projected sales isn’t as dramatic a year-over-year increase as Q2, some on Wall Street took it as a sign of slowing growth, contributing to Nvidia’s share price drop.

Moreover, Huang previously indicated Blackwell production would ramp up in fiscal Q3, so the delay to Q4 affected Q3 sales estimates.

However, the consensus among Wall Street analysts is a “buy” rating with a median price target of $147.80 for Nvidia stock. As this target reveals, Wall Street believes there’s still good upside for shares, especially after the recent price drop.

To buy or not to buy Nvidia shares

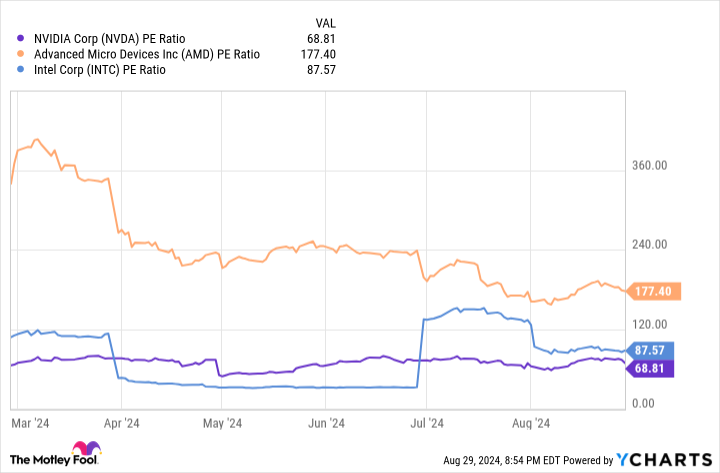

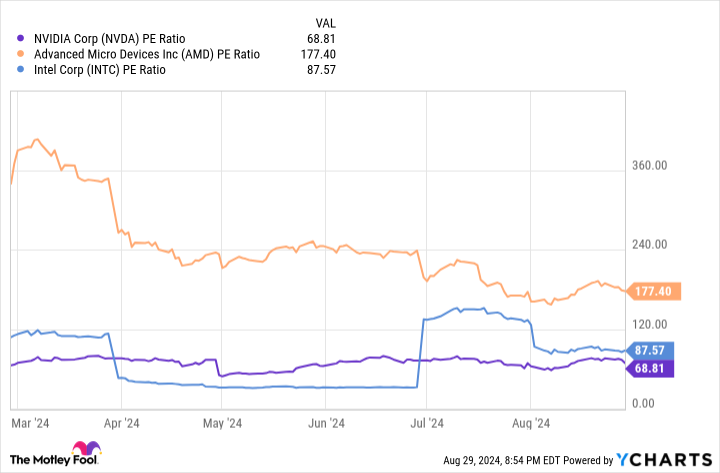

I agree with the Wall Street consensus that Nvidia stock is a buy. Looking at the company’s price-to-earnings ratio (P/E ratio), a widely used metric to assess stock valuation, Nvidia looks undervalued compared to major competitors AMD and Intel.

Contributing to this is Nvidia’s growth in diluted earnings per share (EPS). In Q2, EPS reached $0.67, an impressive 168% year-over-year increase. In addition, the company more than doubled its fiscal Q2 free cash flow (FCF) to $13.5 billion from $6.1 billion in 2023.

Another positive factor in Nvidia’s Q2 results is the year-over-year sales growth across all of its lines of business, including its gaming division. Gaming revenue was up 16% year over year to $2.9 billion.

This is significant because rival AMD’s Q2 gaming sales plunged a whopping 59% year over year to $648 million. As its results demonstrate, Nvidia is able to maintain strong demand, even in markets where competitors struggle.

This strength lends credence to estimates that Nvidia commands in the neighborhood of 70% to 95% of the GPU market for AI. And with the AI industry forecast to grow from $136 billion last year to $826 billion by 2030, the long-term investor has many years of industry growth to reap the rewards of owning Nvidia stock.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Robert Izquierdo has positions in Advanced Micro Devices, Intel, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Is Now the Time to Buy Nvidia Stock? was originally published by The Motley Fool

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews