CashNews.co

The capital markets have gotten off to a sizzling start in 2024. The S&P 500 has soared roughly 16.5%, while the tech-heavy Nasdaq Composite has notched a 20% gain.

One of the biggest themes fueling buying activity in the markets right now is hype around artificial intelligence (AI). And while AI comes in many forms, semiconductor stocks have been particularly big beneficiaries of the AI revolution.

Perhaps the biggest name among chip stocks is Nvidia, which has returned 127% so far in 2024.

Although Nvidia makes for a tempting buy, investors may be better off looking at alternatives.

Let’s dig into why investors need not panic if they feel like they’ve missed the Nvidia train, and explore why the VanEck Semiconductor ETF (NASDAQ: SMH) could be a better option in the long run.

This ETF is spectacular

One of the best ways to invest in the capital markets is through exchange-traded funds (ETFs). ETFs are unique vehicles because they are composed of individual stocks, thereby providing investors with a high degree of diversification.

The fund currently holds 26 positions in different chip stocks. By owning the VanEck Semiconductor ETF, investors automatically gain exposure to quality opportunities in the AI chip space, such as Nvidia, Taiwan Semiconductor, Broadcom, Advanced Micro Devices, Intel, and Micron Technology.

On the surface, the VanEck Semiconductor ETF provides investors with a mechanism to own a variety of different chip stocks. But the more subtle trade-off is that investors also acquire an exposure to different end markets within the chip space in general.

In other words, while each chip stock mentioned above is related in some form or fashion, many of them operate in different capacities. This means that VanEck Semiconductor ETF provides investors with an additional layer of diversification and even more exposure to the broader AI industry than initially realized.

Taking a passive approach has its benefits

Another reason why investing passively through an ETF could be superior to owning individual stocks is that it inherently makes portfolio management a lot easier.

When you own individual stocks, it’s generally a good idea to dial into earnings calls and listen to management’s commentary about the business. Moreover, keeping a keen eye on the company’s growth, expense management, and profitability trends can be helpful when determining if you want to change your position in the stock.

The main problem here is that this type of analysis requires a good deal of time and an astute understanding of financial analysis.

As it relates to semiconductors, in particular, there is a pretty big risk that investors should be aware of. Namely, chip businesses tend to be cyclical.

Right now, semiconductors are in high demand thanks to the booming interest surrounding AI-powered applications.

However, these demand trends will eventually be curtailed. As a result, companies such as Nvidia and its cohorts will likely experience some deceleration in revenue and profits. When this occurs, there’s a good chance that Nvidia and other stocks will witness some sell-offs.

Owning the VanEck Semiconductor ETF mitigates this risk. Although the fund is widely exposed to chip businesses, professional money managers are responsible for monitoring trends among semiconductor businesses and updating allocations in the ETF on an appropriate basis.

For these reasons, I think the VanEck Semiconductor ETF has a good chance of outperforming most individual stocks in the AI space or chip industry over the long run.

Is the VanEck Semiconductor ETF a good buy right now?

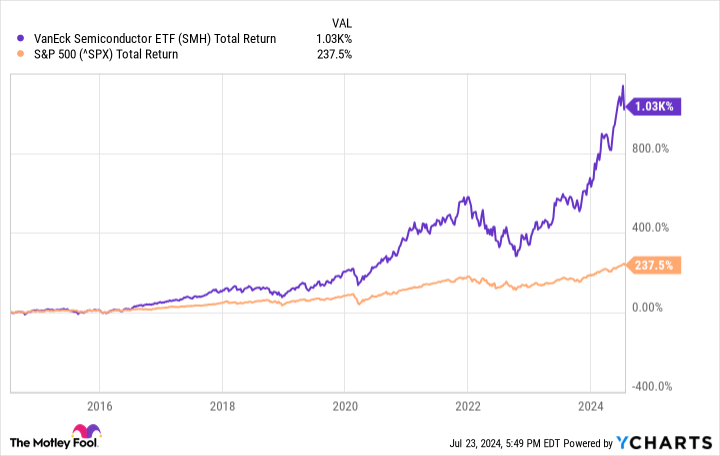

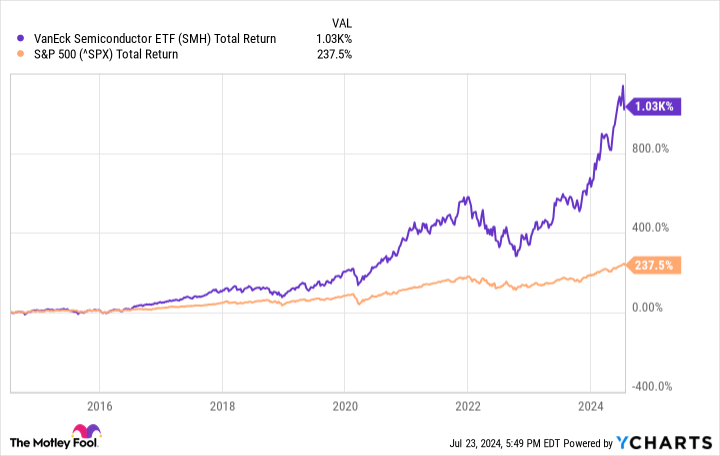

The chart below illustrates the total return of the VanEck Semiconductor ETF over the last 10 years.

Clearly the VanEck Semiconductor ETF has largely outperformed the S&P 500. However, it’s important to call out the slope of the VanEck Semiconductor ETF’s return since 2022. Considering AI has become the tech sector’s newest shiny object over the last 18 months or so, it’s not entirely surprising to see the gains in the VanEck Semiconductor ETF climb so steeply in a relatively short time frame.

Another important note to call out is that with an expense ratio of just 0.35%, the VanEck Semiconductor ETF is far more reasonable than other tech-focused index funds. For example, the Invesco Semiconductors ETF boasts a management fee of 0.57%, while the First Trust Nasdaq Semiconductor ETF has an expense ratio of 0.60%.

Considering its strong historical returns, deep level of diversification, and reasonable management fees, I think the VanEck Semiconductor ETF is a great option for investors looking for a healthy exposure to top quality chip stocks as well as the AI industry more broadly.

Should you invest $1,000 in VanEck ETF Trust – VanEck Semiconductor ETF right now?

Before you buy stock in VanEck ETF Trust – VanEck Semiconductor ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and VanEck ETF Trust – VanEck Semiconductor ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 22, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Missed Out on Nvidia? This Spectacular ETF May Be a Better Buy Anyway was originally published by The Motley Fool

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews