CashNews.co

For the better part of two years, artificial intelligence (AI) has been the hottest thing since sliced bread on Wall Street. The prospect of AI-driven software and systems learning without human intervention gives this technology broad-reaching utility in almost every sector and industry.

Though we’ve seen no shortage of next-big-thing trends come and go on Wall Street since the advent of the internet three decades ago, none have offered as large of an addressable market as artificial intelligence. Based on a report issued by researchers at PwC, AI is forecast to add $15.7 trillion to the global economy in 2030.

While a number of stocks have soared on the heels of the AI revolution, no company has benefited more than semiconductor goliath Nvidia (NASDAQ: NVDA).

Nvidia is on the cutting edge of Wall Street’s hottest trend

In the blink of an eye, Nvidia’s AI-graphics processing units (GPUs) became the undisputed top choice by businesses looking run generative AI solutions and train large language models. Nvidia’s H100 chip has been backlogged due to excess demand, while its successor chip, Blackwell, is estimated to be sold out well into 2025. Blackwell is set to make its debut during the first quarter of next year.

The beauty of AI-GPU demand overwhelming supply is that it puts the ball completely in Nvidia’s court when it comes to pricing power. Nvidia’s GPU hardware has consistently been priced at a 100% to 300% premium to competing chips — and businesses are eagerly lining up to pay this higher price. Over the last six quarters, Nvidia’s adjusted gross margin has expanded by more than 10 percentage points, largely thanks to this otherworldly pricing power.

During the fiscal second quarter of 2025 (ended July 28), Nvidia delivered sales growth of 122% and reported just a hair over $30 billion in sales. For some context on just how quickly Nvidia has ramped its sales, it generated a little north of $6 billion in revenue for the fourth quarter of fiscal 2023.

But while it’s looked every bit like Wall Street’s textbook growth stock, Nvidia threw the ultimate smoke-and-mirrors curveball to investors with one aspect of its latest report.

Nvidia’s $50 billion share buyback is nothing more than a smoke-and-mirrors campaign

With professional and everyday investors looking for Nvidia to report blowout second-quarter sales growth and hype up its future hardware and software offerings — the company’s CUDA software toolkit has played a key role in keeping enterprise clients loyal to its AI-GPUs — Nvidia delivered the news that its board had approved a $50 billion share repurchasing program. This comes atop the $7.5 billion remaining from a previously announced buyback allotment.

The purpose of buyback programs is to signal to investors that a company’s board believes its stock is being undervalued by Wall Street and investors.

Furthermore, buying back stock has the ability to reduce a company’s outstanding share count, which can provide an upward lift to earnings per share (EPS). In other words, it can make a stock more attractive to fundamentally focused investors.

However, devoting up to $50 billion to a buyback program isn’t something you’d expect from a hypergrowth company that’s expected to spend a small fortune on researching and developing new products and services tied to the AI revolution.

One reason this is a complete smoke-and-mirrors move is because the company is dangling the prospect of repurchasing an additional $50 billion worth of its stock at a time when insiders are selling their shares at a historic pace. Since the midpoint of June, CEO Jensen Huang has disposed of around $600 million worth of his company’s stock. Net insider selling activity has topped $1.6 billion over the trailing-12-month period.

To add to the above, no insider has purchased a single share of their company’s stock on the open market since Chief Financial Officer Colette Kress bought 200 shares in (wait for it…) December 2020!

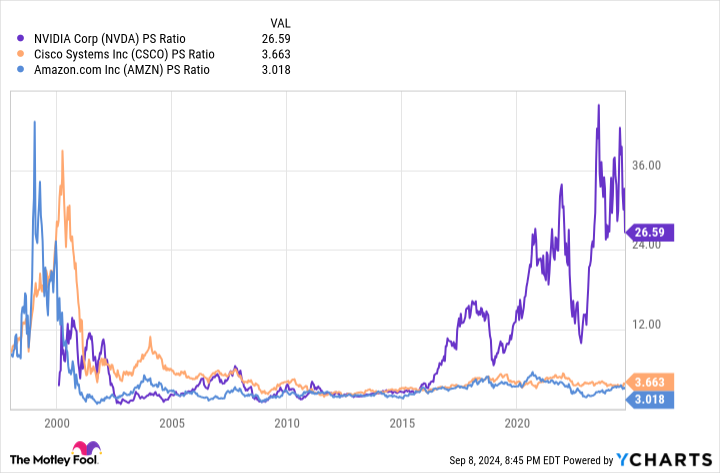

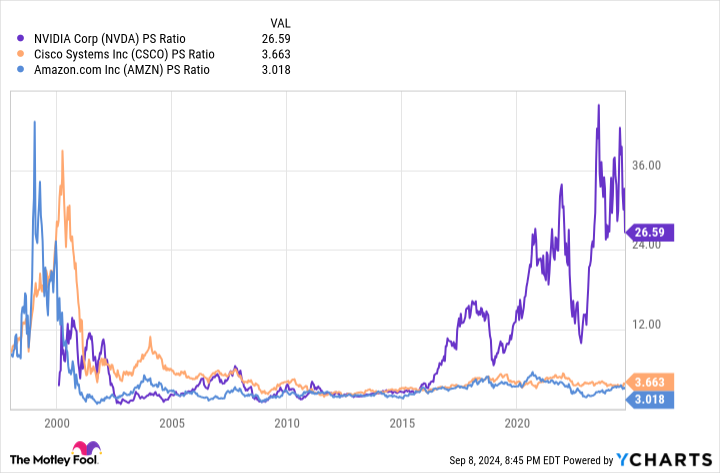

If this isn’t egregious enough, Nvidia is attempting to signal that its stock is undervalued at a time when its shares are historically pricey, relative to its trailing-12-month (TTM) price-to-sales (P/S) ratio.

Throughout history, you can count on one hand how many times we’ve witnessed market-leading companies approach a TTM P/S ratio of 40. The last time this occurred, both Amazon and Cisco Systems went on to lose around 90% of their respective value following the bursting of the dot-com bubble.

Dangling the carrot of buybacks at a time when Nvidia’s valuation is historically expensive is the ultimate smoke-and-mirrors campaign.

History would like a word, too

Looking beyond Nvidia’s head-scratching share repurchase announcement, investors should also note the warning history provides when it comes to next-big-thing innovations, technologies, and trends.

While there’s no question that big dollar figures tied to large addressable markets can lead to emotion-driven euphoria on Wall Street, history has repeatedly shown that every highly touted innovation, technology, and trend over the last 30 years has, eventually, navigated its way through an early stage bubble.

The catalyst for this bubble is investors who consistently overestimate the adoption and/or utility of next-big-thing trends. Although artificial intelligence has a promising future, the simple fact that most businesses lack a well-defined game plan to grow their sales and increase their profits is a glaring warning that investor expectations are outpacing reality.

History also tells us that every game-changing technology has needed time to mature. It took more than a half-decade for business-to-business commerce to find its footing following the proliferation of the internet in the mid-1990s. It’s going to take time for businesses to figure out what they have with AI and how to best utilize the technology to meet the needs of their customers.

Long story short, a $50 billion share repurchase program doesn’t hide the fact that Nvidia’s insiders are big-time sellers, the stock is historically pricey, and no highly touted innovation has escaped an early innings bubble for three decades.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Cisco Systems, and Nvidia. The Motley Fool has a disclosure policy.

Nvidia’s $50 Billion Share Buyback Is the Ultimate Smoke-and-Mirrors Campaign was originally published by The Motley Fool

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews