CashNews.co

This year, Vistra Corp.’s VST strong rally could potentially hinder NVIDIA Corporation NVDA from becoming the S&P 500’s top annual performer back to back, a title held only by Advanced Micro Devices, Inc. AMD since 1999.

However, Vistra’s stupendous gains have made the stock pricey. So, let’s look at how to trade the VST stock.

Vistra (Not NVIDIA) is the S&P 500’s Top YTD Gainer

Wall Street darling NVIDIA squashed bubble fears and witnessed a meteoric rise this year with the arrival of artificial intelligence (AI).

Shipment of the much-awaited next-generation Blackwell chips by the end of the year and sheer dominance in the graphic processing units (GPU) market has given the magnificent 7 stock an edge over its peers.

Most importantly, NVIDIA stock got a boost from the Federal Reserve’s major interest rate cuts. Lower interest rates don’t affect NVIDIA’s crucial cash flows for growth. Also, lower borrowing costs boost its profit margins (read more: Post-Fed Rate Cut: Buy, Hold, or Sell NVIDIA Stock?).

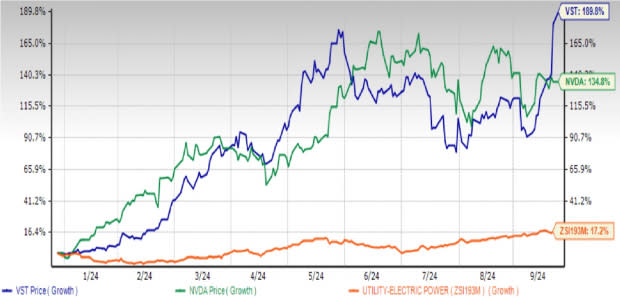

As a result, NVIDIA’s shares have soared 134.8% this year and remained the S&P 500’s top performer for quite some time. However, Vistra, a not-so-household name, toppled NVIDIA last week to become the best-performing stock in the S&P 500, an index it joined not long ago.

The change in the top position took place as investors showed keen interest in an electric company rather than semiconductor stocks to play the boom in AI.

Vistra shares scaled upward for its nuclear power business and high demand from power-consuming AI data centers. Vistra is poised to capitalize on AI data center power needs with its exclusive gas and nuclear power plants mix.

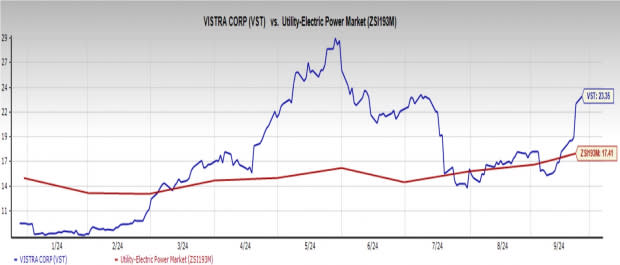

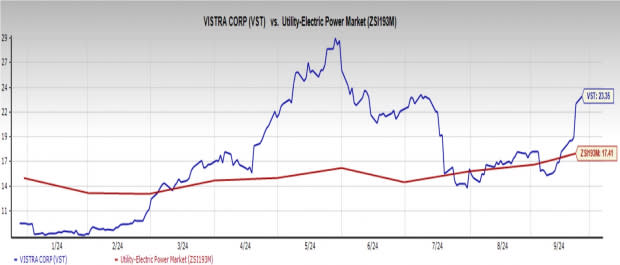

The Vistra stock climbed 189.8% year to date, while its peers trailed, with the Utility – Electric Power industry soaring 17.2%.

Image Source: Zacks Investment Research

Key VST Stock Tailwinds

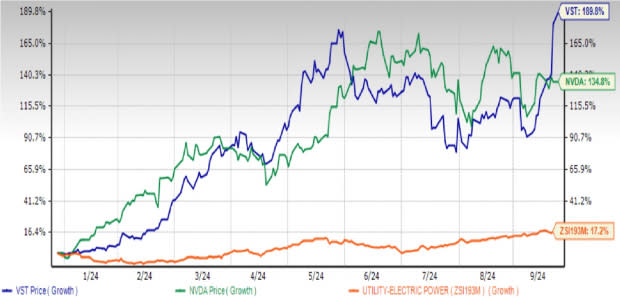

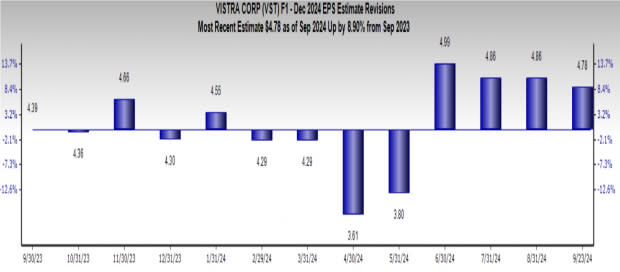

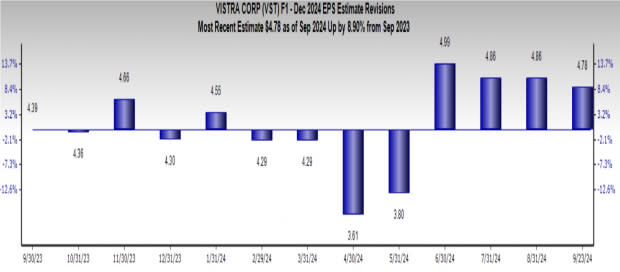

It’s just not power requirements for data centers that are propelling Vistra shares upward. According to analyst Julien Dumoulin-Smith of Jefferies, Vistra stands to gain from an increase in power prices, increased plant usage and likely contracts with data centers. Hence, the $4.78 Zacks Consensus Estimate for VST’s earnings per share is up 8.9% year over year.

Image Source: Zacks Investment Research

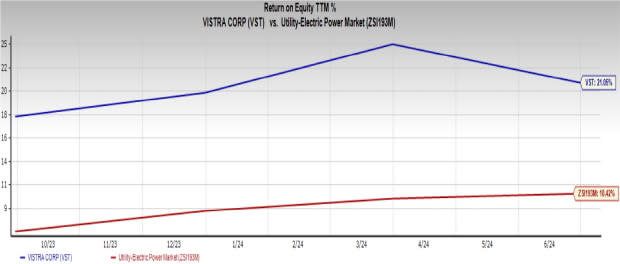

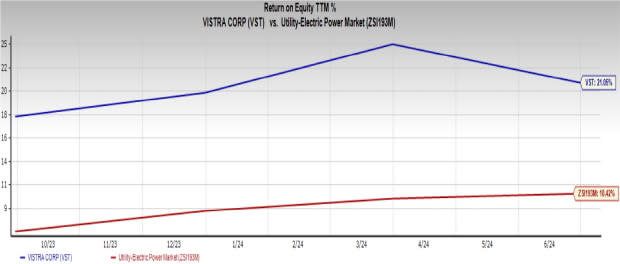

Vistra has also generated profits significantly, which boosted its share price. After all, the VST stock has a return on equity (ROE) of 21.1%, more than the industry’s 10.4%. Any ROE above 20% is considered to be very strong.

Image Source: Zacks Investment Research

Time to Buy VST Stock?

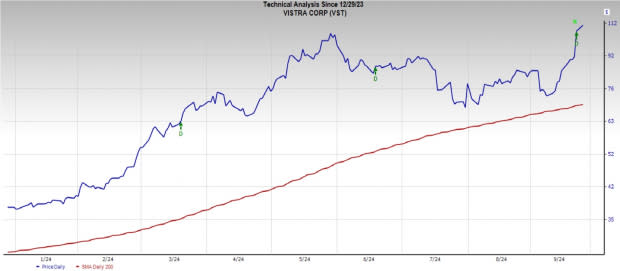

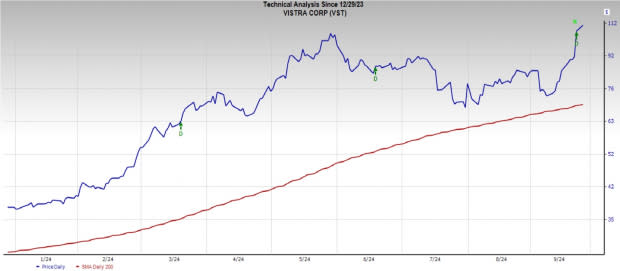

Banking on the AI boom, increase in wholesale power prices and potential to generate profits competently not only helped Vistra to be the top performer in the S&P 500 but also will boost its shares further. Anyhow, the VST stock is trading above the 200-day moving average this year, indicating a long-term uptrend.

Image Source: Zacks Investment Research

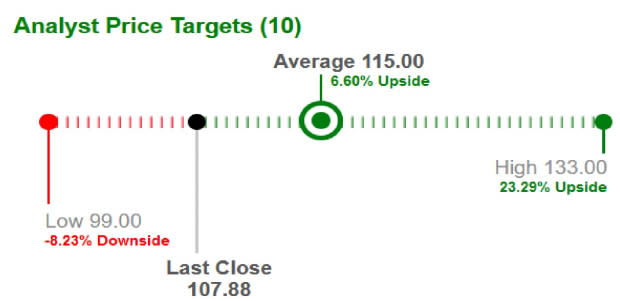

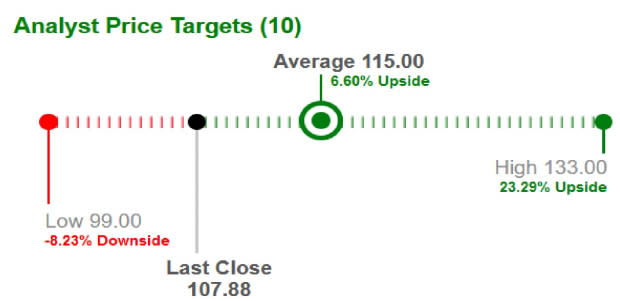

Prominent brokers have also increased the average short-term price target of VST by 6.6% from the stock’s last closing price of $107.88. The highest price target is at $133, an upside of 23.3%.

Image Source: Zacks Investment Research

Thus, those who have invested in the VST stock should stick to it and capitalize on the strong price upside trend. But if you are thinking of buying the stock now, it may burn a hole in your pocket! This is because, per price/earnings, the VST stock, presently, trades at 23.3X forward earnings. However, the industry’s forward earnings multiple is 17.4X. So, better wait for an opportune moment to invest in the VST stock.

Image Source: Zacks Investment Research

Vistra currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews