CashNews.co

While there has been a lot of excitement surrounding the launch of Nvidia‘s (NASDAQ: NVDA) latest chips based on its new Blackwell architecture, both customers and investors apparently will need to wait a bit longer. According to reports, the shipment of the chips will be delayed, although by how long remains to be seen.

Given the strong demand that was expected for the chips, let’s take a closer look at the issue and the impact it may have on the stock.

Design flaw

As first reported by the tech publication website The Information, a design flaw in its Blackwell B200 chip was found “unusually late” in the production process. The issue is believed to stem from the company being one of the first to use Taiwan Semiconductor Manufacturer‘s new CoWoS-L packaging technology (“Chip on Wafer on Substrate with a Local silicon interconnect,” if you’re curious) and the placement of the bridge dies connecting two graphics processing units (GPUs) being less than perfect.

As a result, Nvidia has apparently decided to revamp the design of its Blackwell GPUs, which is expected to delay the start of shipments by three months or more, according to some reports. Customers and partners have indirectly confirmed the delays. Meta Platforms says it doesn’t expect to receive Blackwell GPUs this year, while Super Micro Computer executives say they don’t expect any real volumes from Blackwell until the March quarter.

Alphabet, Microsoft, and Meta all have huge Blackwell orders worth “tens of billions of dollars” that they are looking to get filled, according to The Information. Meanwhile, it was reported earlier this year that Amazon was moving its Nvidia AI accelerator orders from Hopper to Blackwell.

While Hopper orders will likely help fill some of the void resulting from the Blackwell delay, the risk is that there is an air pocket if these customers just wait on their large orders.

UBS analysts, however, have come out and said that, after speaking to Nvidia customers, the firm expects the chip delay to only be between four to six weeks and that the delay will be “invisible” to most customers. This is much shorter than the initial delay that was reported, which has helped lift the stock off its recent lows.

Is it time to buy Nvidia stock?

The length of the delay for Blackwell will likely have a big impact on Nvidia in the short term. A short delay will likely be good for the stock with hardly any impact on its 2025 results, while a delay of three months or more would be looked upon unfavorably, especially after the idea of a shorter delay has already been floated by a Wall Street analyst.

There also is the question of whether the design flaw could cause a chip failure or whether it was just leading to less-than-expected production yields. Either way, it appears that the company’s decision to delay production of the chip and fix any issues is a smart move.

Longer term, the bigger question surrounding the chip issues is whether Nvidia has sped up its development timeline too quickly. The company has cut its planned development cycle for new chip architectures from two years to one. This should keep demand and prices high, but it’s also an aggressive schedule with limited room for error or delays. Being at the forefront of new technology and delivering mass production of your products are two separate things that may not always coincide in the future as well. So these are some risks to consider.

That said, with a number of customers having absolutely huge orders for its chips, demand is not an issue for Nvidia. Customers are currently more concerned about falling behind in the artificial intelligence (AI) race than overbuilding capacity. As large language models (LLMs) become more advanced, they will need more and more computing power, which means more GPUs will be needed. For example, Meta said its Llama 4 LLM will likely need 10 times the computing power of its previous version to train.

And that right there is the biggest reason to own Nvidia. With a dominant market position in the GPU space, Nvidia will continue to be the biggest beneficiary of the continued push for more computing power.

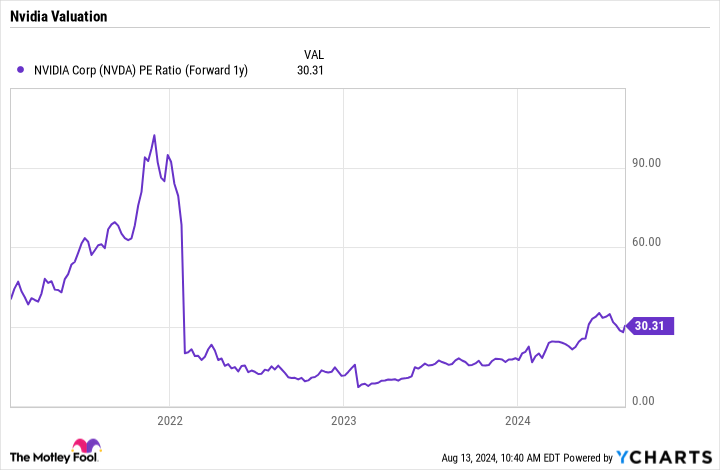

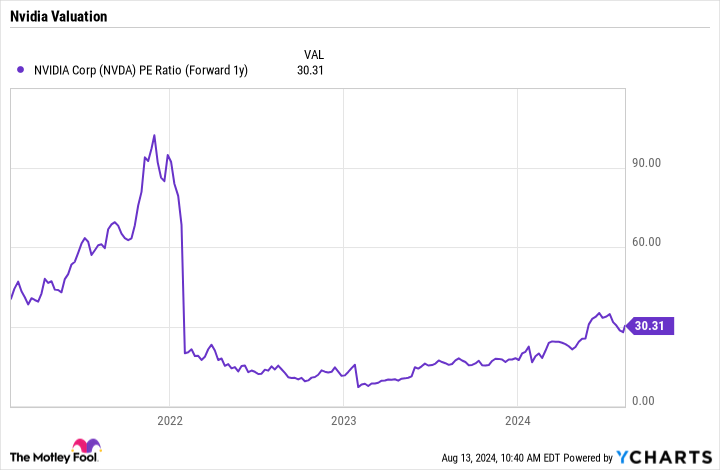

At the same time, the stock trades at a forward price-to-earning (P/E) ratio of about 30 times based on 2025 analyst estimates. For a company with the growth and long-term prospects of Nvidia, that valuation is quite attractive.

NVDA PE Ratio (Forward 1y) data by YCharts.

So while there are risks associated with the Blackwell delay, long-term investors can still look to buy Nvidia at current levels.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

With Its Blackwell Chips Delayed, Should Investors Delay Buying Nvidia Stock? was originally published by The Motley Fool

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews